Passive Income with ByBit Bots — Expert Guide to Automated Trading

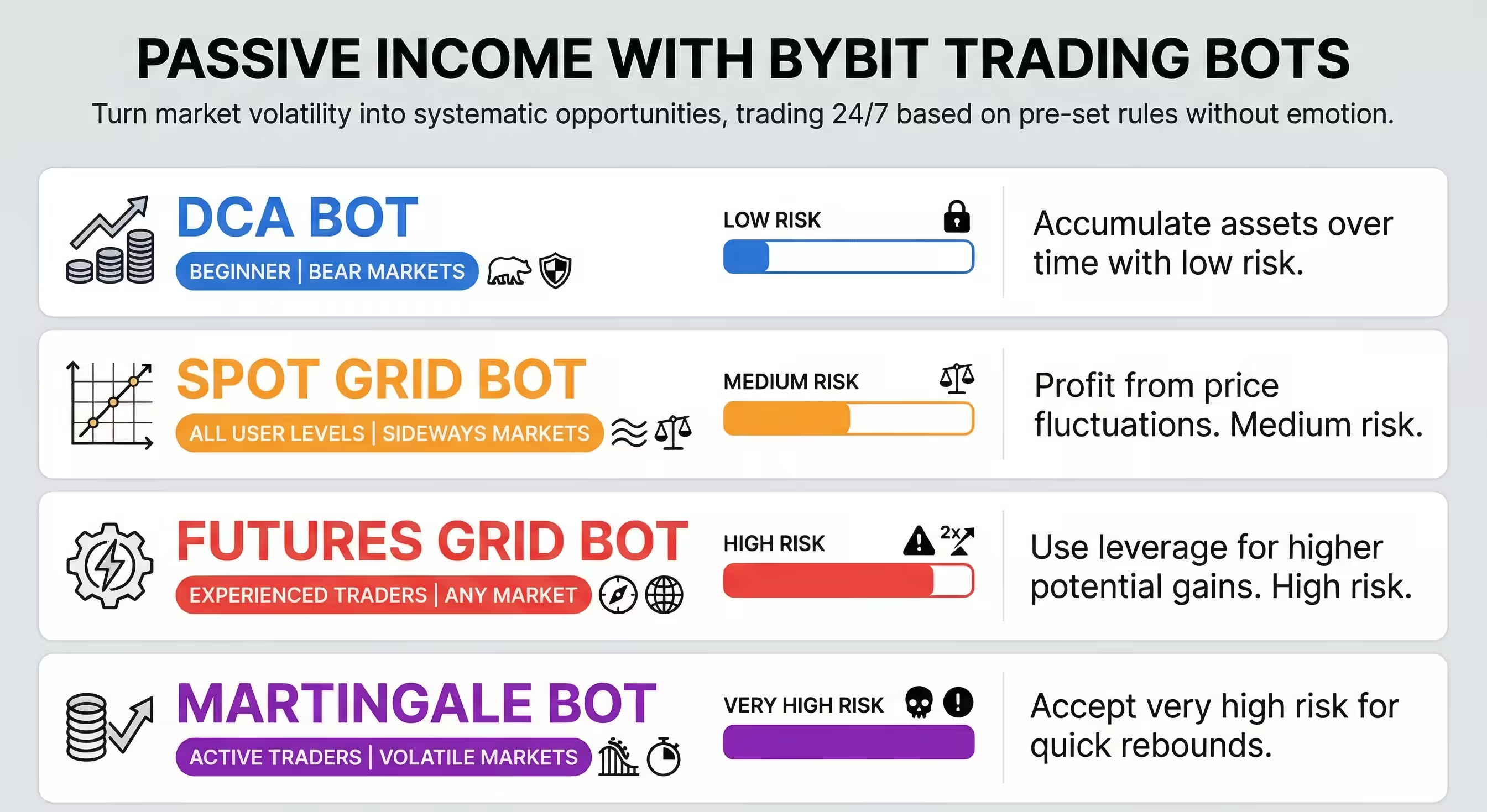

Passive income with ByBit Trading Bots is achieved by using automated trading systems that run predefined strategies 24/7, remove emotions from trading, and help users systematically profit from market volatility while maintaining risk control.

If you want a safer, truly passive overview before bots, see Passive Income with Crypto — A Practical Guide for Long-Term Investors. For exchange-based yield products (non-bot), see Binance Simple Earn and Dual Investment.

Table of Contents:

- How ByBit Trading Bots Work

- Benefits and Limitations of Automation

- Practical Tips for Using ByBit Trading Bots

Realistic Returns and the Passive Income Mindset with ByBit Bots

- FAQ

| Bot Type | Best Market | For Whom | Main Idea | Risk Level | Monitoring |

|---|---|---|---|---|---|

| DCA Bot | Bear or long-term | Beginners | Regular buying to average entry | Low | Minimal |

| Sideways market | Beginners to pro | Buy low, sell high in a range | Medium | Periodic | |

| Experienced users | Grid trading with leverage | High | Constant | Martingale Bot | |

| traders | Increase size on drops | Very High | Constant |

How ByBit Trading Bots Work 🤖

ByBit trading bots are automated systems that execute trades based on rules you define in advance, such as price ranges, order size, intervals, and risk limits. Once launched, the bot continuously monitors the market and places orders whenever conditions are met. Instead of reacting emotionally to every price swing, the bot follows pure logic and probability. It operates 24/7, capturing opportunities even when you are offline, which makes it especially useful for traders who want systematic exposure to crypto markets without constant screen time. The core idea behind пассивный доход с помощью ботов на ByBit is not chasing quick wins, but letting simple strategies run consistently at scale, where many small trades can gradually compound into meaningful results.

🤖 DCA Bot

- Risk level: low

- Monitoring: minimal, once every few days

- Expected return: 5 to 20 percent APR

- Best for: beginners and long-term investors

The DCA bot is built around the principle of regular accumulation. It buys a fixed amount of a cryptocurrency at predefined time intervals, such as every day or every week, regardless of the current market price. Over time, this creates an averaged entry price that smooths out volatility and reduces the risk of buying everything at a local top. This approach is well suited for beginners and long-term investors who believe in the asset’s future but do not want to time the market. In bearish or uncertain conditions, the DCA bot helps build a position calmly while avoiding emotional decisions. Once configured, it usually requires very little attention beyond checking that sufficient funds remain on the balance.

🤖 Spot Grid Bot

- >Risk level: medium

- >Monitoring: periodic, every few days

- >Expected return: 10 to 50 percent APR

- >Best for: beginners to intermediate traders

A spot grid bot is designed to profit from price fluctuations within a chosen range. You define upper and lower boundaries, and the bot places a series of buy and sell orders between them. Each time the price moves up and down inside this corridor, the bot buys lower and sells higher, locking in small but frequent gains. This strategy works best in sideways or moderately volatile markets where price oscillates rather than trends strongly in one direction. For newcomers, ByBit offers AI presets that automatically calculate grid parameters from historical data, while experienced traders can fine-tune grids based on support and resistance levels. The bot needs periodic review, because if the price breaks out of the range, trading activity slows or stops until the range is adjusted.

🤖 Futures Grid Bot

- Risk level: high

- Monitoring: frequent, often daily

- Expected return: 20 to 100 percent APR

- Best for: experienced futures traders

The futures grid bot applies the same grid logic but on perpetual futures contracts, which allows the use of leverage and the ability to trade both long and short. This means the bot can potentially generate profits in rising, falling, or neutral markets, depending on how it is configured. Leverage, however, significantly increases risk, since adverse moves are magnified and can lead to liquidation if margin is insufficient. Because of this, futures grid bots are better suited for experienced users who understand funding rates, margin requirements, and liquidation mechanics. Active monitoring is essential, especially during sharp market moves, as conditions can change much faster than on the spot market.

🤖 Martingale Bot

- Risk level: very high

- Monitoring: constant

- Expected return: 30 to 150 percent APR in favorable markets

- Best for: active and risk-tolerant traders

The martingale bot is based on a more aggressive averaging strategy. When the price moves against the initial position, the bot increases the position size according to predefined rules, aiming to lower the average entry price. When the market eventually rebounds, even a small move can be enough to close the entire position in profit. In volatile markets with frequent pullbacks, this can work effectively and generate quick gains. However, during strong one-directional trends without meaningful reversals, position size can grow rapidly and consume margin, leading to large losses. For this reason, martingale bots require strict limits on order size and depth, and they are suitable only for traders who clearly understand and accept the elevated risk profile.

Benefits and Limitations of Automation ⚖️

Automation has become popular because it solves many psychological and practical problems of manual trading, but it also introduces its own risks that every user should clearly understand before relying on bots for passive income.

✅ Key Benefits of Trading Bots

-

24/7 market coverage

Bots trade non-stop, capturing opportunities day and night. In crypto markets that operate 168 hours per week, this can increase trade frequency by 3 to 5 times compared to manual trading. -

Emotion-free execution

Bots remove fear during drawdowns and greed during rallies. Studies and exchange statistics show that emotional mistakes are responsible for up to 70 percent of retail trading losses. -

High speed and precision

Orders are placed in milliseconds, allowing bots to capture small price moves of 0.2 to 1 percent that are often missed by manual traders. -

Strong performance in ranging markets

In sideways markets where price fluctuates within a 5 to 15 percent range, grid bots can generate steady daily returns of around 0.1 to 0.5 percent before fees. -

Scalable systematic execution

A simple strategy repeated hundreds of times per month can compound into 10 to 40 percent annualized returns in favorable market conditions.

⚠️ Main Limitations and Risks

-

No protection from black swan events

Sudden crashes of 20 to 40 percent within hours have happened multiple times in crypto history. Bots cannot react intelligently to such events unless stopped manually. -

Range breakouts reduce efficiency

When price trends strongly beyond the configured corridor, grid bots may stop trading, while capital can remain locked in positions with unrealized losses of 10 to 30 percent. -

Liquidation risk on futures

With leverage of 5x to 10x, a price move of just 8 to 15 percent against the position can trigger liquidation, wiping out most of the allocated margin. -

Temporary drawdowns are normal

Even profitable bots may experience equity drawdowns of 10 to 25 percent during adverse market phases before recovering. -

Fees can eat into profits

High-frequency strategies may generate hundreds of trades per month. With trading fees around 0.04 to 0.1 percent per trade, total costs can consume 10 to 30 percent of gross profits. -

Over-optimization danger

Bots tuned too closely to historical data may fail when volatility, volume, or market structure changes, leading to underperformance in live trading.

⚖️ Finding the Right Balance

The real strength of automation lies in realistic expectations and disciplined risk control. Allocating only 5 to 15 percent of total capital per bot, keeping leverage conservative at 3x to 5x, and reviewing performance weekly can significantly improve long-term results.

When used correctly, trading bots can help turn market volatility into a consistent stream of small gains, but they should always be treated as tools within a broader risk-managed strategy rather than a fully hands-off source of income.

Practical Tips for Using ByBit Trading Bots 🛠️

Below are practical tips that help turn ByBit bots into a long-term tool for passive income rather than a short-term experiment.

💡 Start simple and test with small amounts

Whether you build your own strategy or copy an existing one, begin with the simplest setup and minimal capital. Run the bot with a small amount for several days to understand how it behaves in real market conditions before scaling up. This protects you from early mistakes and helps you learn without stress.

🔍 Check how other bots really perform

When copying bots, do not focus only on high APR. Look at how long the bot has been running, whether it survived both rising and falling markets, and what its maximum drawdown looks like. A practical approach is to copy two or three different bots with small allocations and compare their stability over time.

🧩 Do not go all in on one strategy

Never allocate your entire capital to a single bot or setup. Splitting funds across multiple strategies reduces the impact of one poor configuration and gives you more flexibility to adapt as market conditions change.

⏳ Think long term, not fast profits

Bot trading works best when treated like long-term investing, not active day trading. Grid profits often accumulate slowly over weeks, not days. Patience is essential if your goal is steady passive income rather than quick wins.

📏 Use wider grids for uncertain markets

In volatile or unclear conditions, wider price ranges are usually safer. A grid covering 20 to 40 percent of the price range is more likely to stay active during sharp drops than a tight grid that breaks easily. Wider grids trade less often, but they survive longer.

🛡️ Stick to reliable assets

Focus on high-liquidity, large-cap pairs such as BTC/USDT or ETH/USDT. These assets are less likely to collapse to zero and have stronger long-term potential. Highly speculative altcoins may look attractive but carry much higher risk for automated strategies.

📊 Scale gradually as confidence grows

Start with about 5 to 10 percent of your total capital per bot. Increase exposure only after the strategy proves itself across different market phases. Gradual scaling helps control risk and keeps emotions in check.

🔄 Review regularly, but avoid micromanaging

Check your bots once a day or every few days. Constant tweaking often leads to emotional decisions that defeat the purpose of automation. Adjust only when market structure clearly changes or when the bot no longer fits current conditions.

Used this way, both custom setups and copied strategies can become reliable tools for building passive income with ByBit bots over time.

Realistic Returns and the Passive Income Mindset with ByBit Bots 📈💡🚀

📈 Realistic returns over time

Trading bots are tools for structuring and compounding capital, not for instant wealth. In short favorable periods, dashboards may show eye-catching numbers like 100 or even 200 percent APR, but in practice these figures usually reflect temporary market conditions. Over longer horizons, more realistic expectations for well-managed grid and futures bots often fall in the range of 10 to 40 percent per year, depending on volatility, fees, and risk settings. DCA strategies tend to track the underlying asset performance, adding discipline rather than extra alpha.

It is normal for bots to experience drawdowns. A spot grid bot, for example, may show an unrealized loss of 10 to 30 percent if the asset price drops sharply, while still generating small grid profits in the background. Understanding the difference between unrealized equity swings and realized grid income is crucial. Without this, users often stop bots at the worst possible moment, locking in losses instead of allowing the strategy to work through the cycle.

A prudent approach is to start by allocating only a small portion of capital, typically around 5 to 10 percent per bot, and observe behavior across calm days, high volatility, and trend shifts before increasing exposure.

💡 Why bot trading feels like passive income

Пассивный доход с помощью ботов на ByBit feels passive because once the system is configured, it continues to operate without constant manual input. Orders are placed automatically, profits are collected in small portions, and there is no need to watch charts all day. This creates the impression of hands-off income.

At the same time, true sustainability comes from the work done before and around automation. Choosing reliable pairs, defining grid ranges, setting leverage and risk limits, and reviewing performance from time to time are what make automation a controlled process rather than blind gambling. The income feels passive in daily routine, but it is supported by active thinking at the strategy level.

In practice, most successful users treat bots as semi-passive tools. They may only check them once a day or every few days, but they stay ready to adjust ranges or stop bots when market structure clearly changes.

🎣 Understanding grid bots through analogy

A grid bot is like placing a fishing net in a river. You position it where fish often pass and let the current do the work. Each time a fish swims into the net, you catch a small reward. If the river changes course and fish stop coming, the net remains empty until you move it.

In the same way, a grid bot earns from price oscillations inside a chosen range. As long as the market flows back and forth, the bot keeps capturing small gains. When the market shifts into a strong trend and leaves the range, profits slow down and the strategy needs repositioning. The analogy helps explain why grids are not set-and-forget forever, but tools that must follow the market regime.

🚀 Is passive income with ByBit bots right for you

ByBit bots are best suited for users who value discipline, patience, and structured execution. They work well for those who prefer systematic processes over emotional decision-making and are comfortable with gradual results rather than quick wins.

Bots do not replace market understanding. Instead, they multiply its effect by executing simple logic nonstop, 24/7. For long-term investors, DCA bots can add discipline to accumulation. For range traders, grid bots can turn sideways markets into steady opportunity. For experienced users, futures bots can enhance flexibility, though with higher risk.

If you are willing to think in terms of weeks and months instead of hours and days, accept temporary drawdowns, and manage risk conservatively, automation on ByBit can become a powerful way to transform volatility into a consistent stream of opportunities while keeping emotions out of the equation.

FAQ ❓

🧠 Are ByBit trading bots actually passive income?

They can feel like passive income because the bot runs 24/7 after setup, but the results depend on market conditions and your configuration. The process is best described as semi-passive: you are not trading manually every day, yet you still need to choose pairs, set ranges, manage risk, and review performance periodically.

🧠 What is a realistic return expectation for passive income with ByBit bots?

Over short periods, returns may look extremely high, but long-term performance usually normalizes. For conservative spot grid setups on liquid assets, many users aim for roughly 10 to 40 percent per year in favorable conditions after fees, while DCA is more about disciplined accumulation than generating additional yield.

🧠 How much money should I start with?

Start small so mistakes are cheap. A common approach is allocating about 5 to 10 percent of your total capital per bot, then scaling only after you observe behavior across different market phases.

🧠 Which bot is best for beginners?

DCA and Spot Grid are usually the most beginner-friendly. DCA is simplest and requires minimal monitoring, while Spot Grid can work well in sideways markets if you choose a reasonable range and stick to liquid pairs.

🧠 What’s the biggest risk with grid bots?

The biggest risk is a regime shift. If the price trends strongly outside your grid range, the bot may stop trading or hold an unrealized loss for a long time. Wider ranges and periodic adjustments help reduce this risk.

🧠 Are futures bots safe?

Futures bots can be useful, but they are inherently riskier because leverage can cause liquidation. Conservative leverage and strict risk limits are essential, and futures bots generally require more monitoring than spot bots.

🧠 How often should I check my bots?

For spot bots, checking once a day or every few days is usually enough. Futures bots may require daily checks or more frequent monitoring during high volatility. The key is to review calmly and avoid emotional over-tweaking.

🧠 Should I copy other people’s bots?

Copying can be a helpful shortcut, but you should evaluate bots by stability and runtime, not just high APR. A practical method is to test-copy two or three bots with small amounts and compare drawdowns and consistency before scaling.

🧠 What pairs are best for bot trading on ByBit?

High-liquidity pairs like BTC/USDT and ETH/USDT are commonly used because they have deep order books and lower risk of going to zero. Very speculative altcoins can be profitable short-term but often carry much higher downside risk for automated strategies.

🧠 Can I lose money using ByBit bots?

Yes. Bots do not guarantee profit. Poor range selection, aggressive leverage, high fees relative to gains, and unexpected market moves can all lead to losses. Treat bots as tools within a risk-managed plan, not as guaranteed income machines.