Passive Income with Crypto — A Practical Guide for Long-Term Investors

Passive income with crypto means earning yield from digital assets without actively trading day to day, typically through network rewards, borrower interest, or trading fees. For US investors who want safer, more sustainable options, the “real” menu is narrower than most social media claims: staking and conservative lending are the foundation, while liquidity pools and yield optimizers can work but require understanding specific risks such as smart-contract exposure and impermanent loss. This pillar guide explains how each method generates returns, what realistic ranges look like in 2026, which approach fits different investor profiles, and what US investors should know about taxes and regulatory constraints before treating crypto yield as long-term passive income.

This guide is for educational purposes only and does not constitute financial or investment advice.

Table of Contents:

- 📊 Quick Overview — Passive Crypto Income at a Glance

- 🧭 What Passive Income with Crypto Really Means in 2026

- 🔒 Crypto Staking — The Foundation of Passive Income with Crypto

- 💰 Crypto Lending — Interest-Based Passive Income with Crypto

- 🌊 Liquidity Pools — How Passive LP Income Really Works

- 📐 Passive Income with Crypto — Returns, APR vs APY, and Real Calculations

- ⚠️ Understanding the Risks of Passive Income with Crypto

- 🇺🇸 Taxes and Legal Considerations for Passive Income with Crypto in the US

- 📊 Passive Income with Crypto vs Traditional Finance

- 🧩 Passive Income with Crypto — Final Thoughts

- ❓ Passive Income with Crypto — Frequently Asked Questions

Quick Overview — Passive Crypto Income at a Glance 📊

| Method | How Income Is Generated | Typical Returns (2026) | Complexity | Main Risk | Best For | Leading Platforms |

|---|---|---|---|---|---|---|

| Crypto Staking | Network rewards for securing proof-of-stake blockchains | 3–8% | Low | Unstaking delays, protocol risk | Long-term holders | Lido, Rocket Pool, Coinbase |

| Crypto Lending | Interest paid by overcollateralized borrowers | 2–6% | Low–Medium | Market stress, smart contract risk | Conservative investors | Aave, Sky, Compound |

| Liquidity Pools | Trading fees from decentralized exchanges | Variable | Medium | Impermanent loss | Market-aware investors | Uniswap, Curve, Aerodrome |

| Yield Optimization | Automated compounding across protocols | Variable | Medium–High | Layered protocol risk | Experienced users | Yearn, Beefy |

| Stablecoin Strategies | Yield on fiat-pegged assets | 2–5% | Low | Depegging, regulatory risk | Income-focused investors | Aave, Sky |

| Trading Bots | Automated active trading strategies | Not passive | High | Drawdowns, strategy failure | Active traders | Covered in Trading section |

What Passive Income with Crypto Really Means in 2026 🧭

True passive income with crypto is generated at the protocol or market-structure level rather than through speculation or timing the market. Reliable passive strategies rely on blockchain mechanics such as staking rewards, lending demand, or trading fees that exist regardless of short-term price movements. Approaches that require frequent adjustments, leverage, or active decision-making fall outside the definition of passive income and should be treated as active trading.

For US investors, this distinction is particularly important due to regulatory constraints and platform availability, which limit access to certain products and services.

Crypto Staking — The Foundation of Passive Income with Crypto 🔒

Crypto staking is the most straightforward and structurally sound way to earn passive income with crypto. By staking assets on proof-of-stake blockchains, investors receive rewards directly from the network for helping maintain security and consensus. Unlike speculative strategies, staking does not depend on market timing or trading activity, which makes it the foundation of conservative crypto income strategies in 2026.

🔹 Types of crypto staking explained

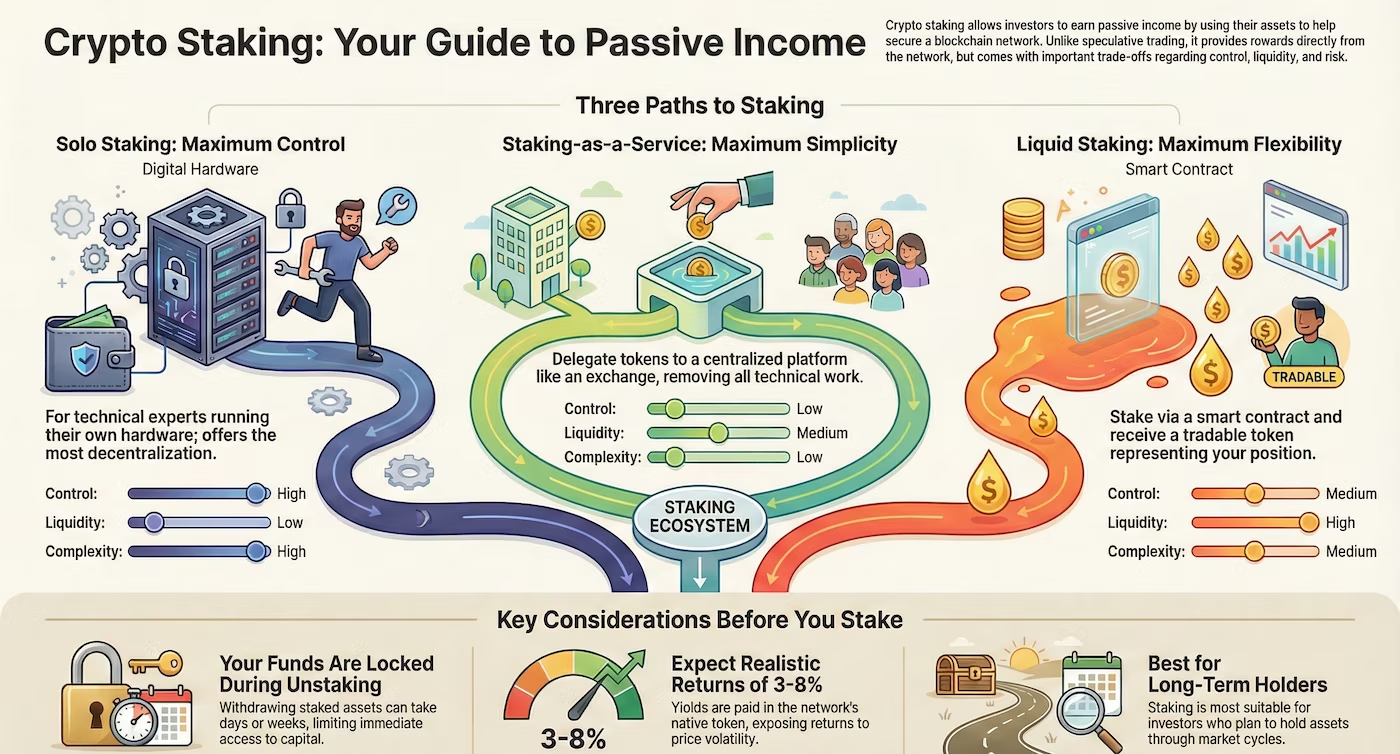

There are three main staking models, each offering a different balance between control, simplicity, and liquidity. Understanding these differences is essential before committing capital.

Solo staking involves running validator infrastructure independently. This approach provides maximum control and avoids smart-contract dependencies, but it requires technical expertise, reliable uptime, and, in many networks, a high minimum stake. For most retail investors, solo staking is impractical despite being the most decentralized option.

Staking-as-a-service allows users to delegate tokens through centralized platforms or custodial providers. The technical burden is removed, making this the simplest option, but users give up direct control over assets and rely on the platform’s operational and regulatory stability. This model introduces counterparty risk and jurisdictional limitations, particularly for US investors.

Liquid staking protocols represent a hybrid approach. Users stake assets via smart contracts and receive liquid tokens that represent their staked position. These tokens can often be traded or used elsewhere in decentralized finance, improving capital efficiency. The trade-off is additional smart-contract risk layered on top of standard staking mechanics.

For readers who want a practical, step-by-step explanation of how liquid staking works in real conditions, including setup, risks, and common mistakes, see our detailed guide on earning passive income with liquid staking.

🔹 Unstaking periods, epochs, and liquidity constraints

One of the most overlooked aspects of passive income with crypto staking is liquidity. In most proof-of-stake networks, staked assets cannot be withdrawn instantly. Withdrawals follow predefined epochs or unstaking periods designed to protect network integrity.

Unstaking periods can range from several days to multiple weeks, depending on the blockchain. During this time, funds do not earn rewards and cannot be sold or transferred. For long-term investors, this limitation is often acceptable, but for those who may need rapid access to capital, it represents a meaningful constraint.

Liquid staking reduces this friction by allowing positions to be exited through secondary markets rather than waiting for protocol-level withdrawal. However, this convenience depends on market liquidity and price stability, and liquid staking tokens may temporarily trade below their underlying value during periods of market stress.

🔹 Expected returns and realistic assumptions

Staking returns are relatively stable compared to other crypto yield strategies. On mature networks such as Ethereum, annual yields typically range between three and five percent. Other large proof-of-stake networks may offer slightly higher rewards, generally between five and eight percent, reflecting different inflation and incentive models.

These returns are paid in native tokens rather than fiat currency, meaning staking income remains exposed to price volatility. As a result, staking should be viewed as a yield-enhancing layer on a long-term holding rather than a fixed-income replacement.

🔹 When staking makes sense as a passive strategy

Crypto staking is best suited for investors with a long-term horizon who are already comfortable holding digital assets through market cycles. It works particularly well when the underlying token is part of a strategic allocation, as staking increases yield without increasing directional exposure.

Staking may be less appropriate for short-term traders or investors who prioritize liquidity above all else. In such cases, withdrawal delays and token price fluctuations can outweigh the benefits of steady network rewards. From a portfolio perspective, staking functions best as a conservative base layer rather than a standalone income product.

| Staking Model | Control | Liquidity | Complexity | Best Use Case |

|---|---|---|---|---|

| Solo Staking | High | Low | High | Advanced users and validators |

| Staking-as-a-Service | Low | Medium | Low | Simplicity-focused investors |

| Liquid Staking | Medium | High | Medium | Passive investors needing flexibility |

🔹 Market leaders in crypto staking

For long-term Ethereum investors, liquid staking protocols such as Lido and Rocket Pool are widely considered industry benchmarks. Lido focuses on maximum liquidity and deep integration across DeFi, while Rocket Pool emphasizes decentralization, which can be important for reducing validator concentration and regulatory exposure.

For investors who prefer custodial solutions, platforms such as Coinbase and Kraken offer exchange-based staking options, although availability and terms may vary for US users.

Crypto Lending — Interest-Based Passive Income with Crypto 💰

Crypto lending is another core method of earning passive income with crypto, based on a familiar financial concept: earning interest by providing capital to borrowers. In contrast to staking, where rewards come from network mechanics, lending income is driven by demand for liquidity. When executed conservatively, crypto lending can offer predictable yield with relatively low operational involvement, making it attractive to risk-aware investors.

🔹 How crypto lending generates income

In crypto lending, users supply assets to lending markets where borrowers take loans backed by collateral. Interest rates fluctuate dynamically based on supply and demand. When borrowing demand increases, rates rise, and lenders earn more. Because most major crypto lending platforms require overcollateralization, borrowers must deposit assets worth more than the loan value, which reduces credit risk compared to traditional unsecured lending.

The key distinction is that lending income does not depend on validating transactions or securing a blockchain. Instead, it reflects market demand for leverage, liquidity, or hedging. This makes lending returns more sensitive to market cycles but also more intuitive for investors familiar with traditional finance.

🔹 CEX lending vs DeFi lending

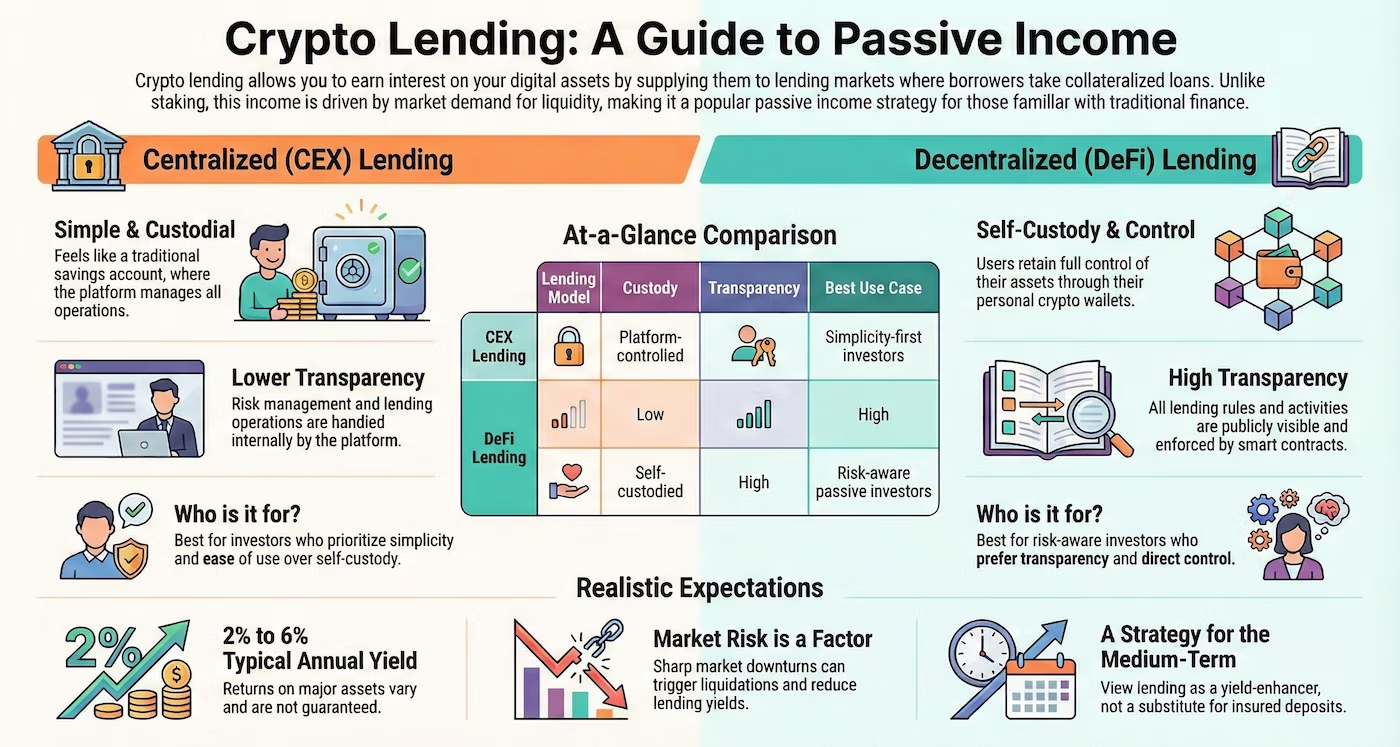

Crypto lending exists in two primary forms: centralized lending through exchanges and decentralized lending through on-chain protocols. While both aim to generate interest, their risk profiles differ significantly.

Centralized exchange lending is typically the simplest option. Users deposit assets, and the platform manages lending operations internally. From a user perspective, this feels similar to a savings account. However, funds are fully custodial, and returns depend on the platform’s internal risk management and regulatory standing. For US investors, availability can change quickly due to regulatory actions, making long-term planning more difficult.

Decentralized lending platforms operate via smart contracts and transparent on-chain rules. Users retain control through their wallets, and all loan parameters are publicly visible. Overcollateralization and automated liquidations reduce counterparty risk, but smart-contract vulnerabilities and protocol-level failures remain possible. This trade-off between transparency and technical risk is central to choosing between CEX and DeFi lending.

🔹 Risk profile and market stress scenarios

Under normal conditions, conservative crypto lending is relatively stable. However, during sharp market downturns, lending markets are stress-tested. Rapid price declines can trigger mass liquidations, temporarily increasing volatility and reducing lending yields. In extreme cases, oracle failures or smart-contract exploits can result in losses.

For passive investors, the safest approach is to focus on large, established protocols, avoid leverage entirely, and supply only high-liquidity assets. Lending should be treated as a yield-enhancing allocation rather than a substitute for cash or insured deposits.

🔹 Expected returns and realistic assumptions

In 2026, typical lending yields on major assets range between two and six percent annually, depending on market conditions. Stable assets tend to offer lower but more consistent returns, while volatile assets may generate higher interest during periods of strong borrowing demand.

Unlike promotional yield farming, lending returns are not fixed. Rates adjust continuously, and periods of low demand can reduce income. This variability reinforces the importance of viewing lending as a medium-term strategy rather than a guaranteed income stream.

🔹 When crypto lending makes sense as a passive strategy

Crypto lending is well suited for conservative investors who want to earn yield without participating directly in trading or liquidity provision. It works best when paired with a long-term outlook and a preference for transparency over maximum yield.

Lending may be less appropriate for investors who require absolute capital stability or immediate liquidity in all market conditions. While safer than many DeFi strategies, lending still carries risks that do not exist in traditional insured financial products.

| Lending Model | Custody | Transparency | Risk Level | Best Use Case |

|---|---|---|---|---|

| CEX Lending | Platform-controlled | Low | Medium | Simplicity-first investors |

| DeFi Lending | Self-custodied | High | Medium | Risk-aware passive investors |

🔹 Market leaders in crypto lending

In decentralized lending, Aave remains the reference point for overcollateralized crypto lending, offering deep liquidity, transparent risk parameters, and a broad range of supported assets.

Sky, formerly MakerDAO, is often preferred by users working primarily with stablecoins, particularly within the USDS and DAI ecosystem.

Compound Finance is commonly viewed as a more conservative alternative, with a narrower asset selection and simpler lending mechanics.

Liquidity Pools — How Passive LP Income Really Works 🌊

Liquidity pools offer a different type of passive income with crypto, based not on protocol rewards or interest, but on trading activity. By providing assets to decentralized exchanges, liquidity providers earn a share of trading fees generated by swaps. This model can be profitable, but it introduces market-driven risks that make liquidity pools fundamentally different from staking or lending.

🔹 How liquidity pools generate income

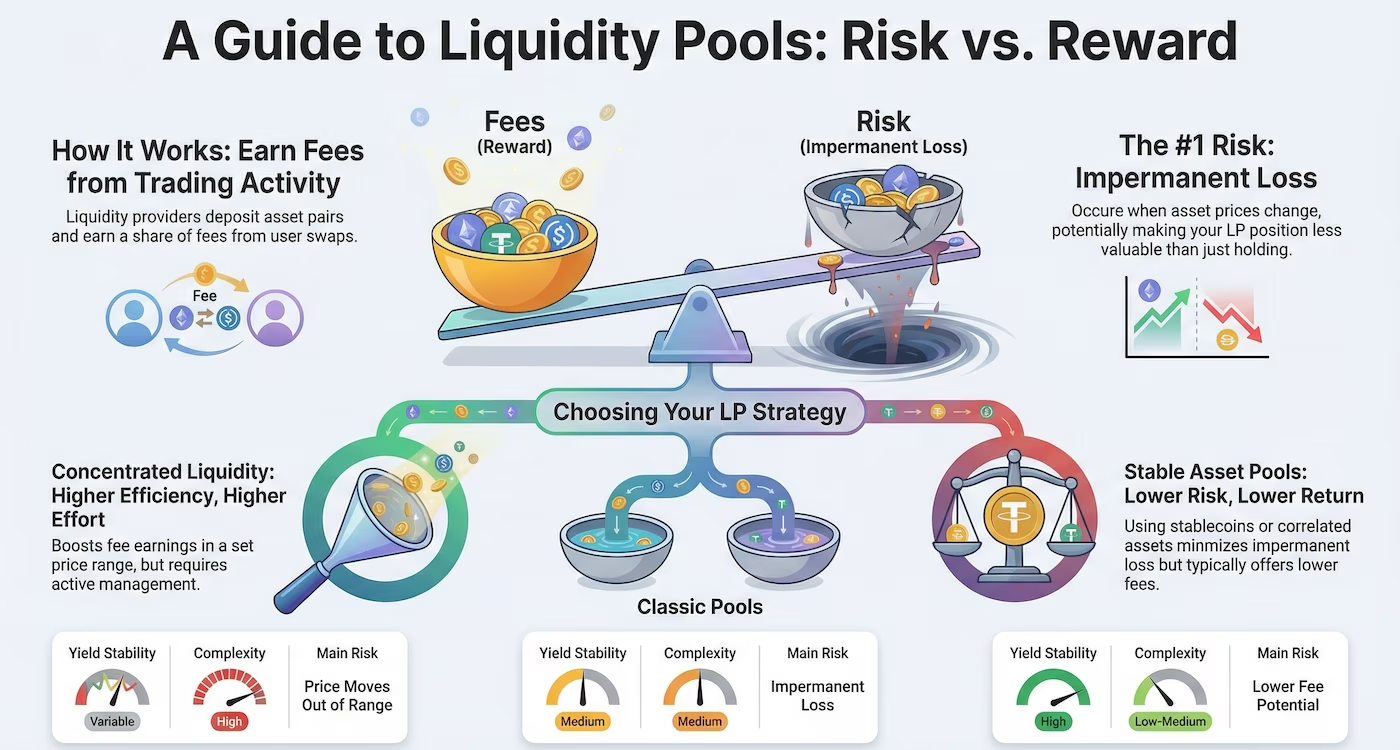

Liquidity pools power decentralized exchanges by allowing users to swap assets without traditional order books. Liquidity providers deposit asset pairs into a pool, and traders pay fees each time they swap through that pool. These fees are distributed proportionally among liquidity providers based on their share of the pool.

Unlike staking or lending, liquidity pool income depends directly on trading volume. High activity leads to higher fees, while quiet markets reduce returns. This makes LP income more variable and closely tied to market sentiment and volatility.

🔹 Impermanent loss and price divergence explained

The most important risk in liquidity pools is impermanent loss. This occurs when the prices of assets in a pool change relative to each other. As traders rebalance the pool through arbitrage, liquidity providers may end up holding a different asset mix than they initially deposited. When prices move significantly, the value of the LP position can be lower than simply holding the assets separately.

Impermanent loss is most pronounced in volatile asset pairs and least severe in stable or closely correlated pairs. While trading fees can offset this loss over time, they do not eliminate it. For passive investors, understanding this trade-off is essential before committing capital.

Not all liquidity-based strategies follow the same mechanics as Ethereum-style pools. A notable example is Jupiter’s JLP on Solana, which uses a structured liquidity model rather than constant-product pools. We break down this approach, its risk profile, and real return mechanics in our guide on earning passive income with JLP on Solana.

🔹 Classic pools vs concentrated liquidity

Early liquidity pools distributed liquidity evenly across all price ranges. This model is simple but capital-inefficient. More modern designs allow liquidity providers to concentrate capital within specific price ranges, increasing fee generation efficiency when prices stay within that range.

Concentrated liquidity introduces a new challenge: if the market price moves outside the chosen range, the position stops earning fees and becomes fully exposed to one asset. This requires monitoring and periodic adjustment, reducing the “passive” nature of the strategy. As a result, concentrated liquidity is better suited for experienced users rather than hands-off investors.

🔹 Stable and correlated asset pools

Liquidity pools based on stablecoins or highly correlated assets reduce exposure to impermanent loss. Because price movements are limited, the asset balance remains relatively stable, and fee income becomes more predictable. These pools are often used by conservative investors seeking fee-based returns with lower volatility.

However, stable pools typically offer lower returns during calm markets. Fee income increases during periods of high volume, but expectations should remain moderate compared to more aggressive strategies.

🔹 Expected returns and realistic assumptions

Liquidity pool returns vary widely depending on market conditions, asset selection, and pool design. During periods of high trading activity, fee income can be attractive. During low-volume markets, returns may fall below staking or lending yields.

LP strategies should be evaluated over longer periods rather than short-term snapshots. Fee income must be weighed against potential impermanent loss and the time required to manage positions, especially in concentrated liquidity setups.

🔹 When liquidity pools make sense as a passive strategy

Liquidity pools are best suited for investors who understand market dynamics and are comfortable with price exposure beyond simple holding. They can work well for those who already plan to hold specific asset pairs and are willing to accept variability in returns.

Liquidity provision may be inappropriate for investors seeking predictable income or minimal oversight. Compared to staking and lending, LP strategies sit higher on the risk and complexity spectrum and should be sized accordingly within a broader portfolio.

| LP Strategy | Yield Stability | Complexity | Main Risk | Best Use Case |

|---|---|---|---|---|

| Classic Pools | Medium | Medium | Impermanent loss | Long-term LP positions |

| Concentrated Liquidity | Variable | High | Out-of-range exposure | Active LP management |

| Stable Asset Pools | High | Low–Medium | Lower fee potential | Conservative LP income |

🔹 Market leaders in liquidity provision

For liquidity provision, Uniswap remains the dominant decentralized exchange, offering the deepest liquidity and advanced pool mechanics, including concentrated liquidity.

Curve Finance is widely used for stablecoin and correlated asset pools, where minimizing slippage and impermanent loss is a priority.

Within the Coinbase ecosystem, Aerodrome has emerged as a leading liquidity hub on the Base network, particularly for users seeking exposure to that ecosystem.

Passive Income with Crypto — Returns, APR vs APY, and Real Calculations 📐

Understanding the math behind passive income with crypto is essential for setting realistic expectations. Many investors focus on headline yields without understanding how returns are calculated, how compounding works, and why similar-looking percentages can lead to very different outcomes over time.

🔹 APR vs APY explained in simple terms

APR represents a simple annual return without accounting for compounding. It shows how much interest is earned over a year assuming rewards are not reinvested. APY, on the other hand, includes the effect of compounding, meaning rewards are periodically reinvested to generate additional returns.

In crypto, staking and lending platforms often advertise APY rather than APR because rewards are frequently auto-compounded or easily reinvested. This can make yields appear higher, even when the underlying rate of return is similar.

The difference between APR and APY becomes more meaningful over longer time horizons, especially for passive strategies designed to run for multiple years.

🔹 What compounding looks like in practice

To illustrate how passive income with crypto works over time, consider a conservative example. An investor stakes ten thousand dollars’ worth of Ethereum at an average yield of four percent annually, with rewards compounded once per year.

After one year, the position grows to approximately ten thousand four hundred dollars. After five years of compounding, the total value reaches roughly twelve thousand one hundred sixty-seven dollars, assuming the yield remains stable and price volatility is ignored.

This example highlights two important points. First, conservative yields can still produce meaningful results over long periods. Second, time in the strategy often matters more than chasing higher short-term returns.

🔹 Why higher APY does not always mean higher profit

High advertised yields often come with higher risk, shorter sustainability, or complex conditions. A twenty percent APY that lasts only a few months may generate less total income than a stable four percent yield maintained over several years.

In addition, many high-APY opportunities expose investors to risks such as impermanent loss, reward token inflation, or sudden yield drops once incentives are removed. For passive income strategies, consistency and predictability usually outweigh peak returns.

🔹 Realistic return expectations in 2026

For US investors focusing on safer passive income with crypto, realistic annual return ranges remain moderate. Staking and conservative lending typically fall between three and six percent. Liquidity pools may exceed this during periods of high activity but can underperform during quiet markets.

Rather than viewing crypto passive income as a replacement for high-risk speculation, it is more useful to compare it to long-term yield-enhancing strategies. When combined with disciplined allocation and risk management, modest returns can compound meaningfully over time.

| Strategy | Typical Yield Type | Compounding Effect | Return Stability |

|---|---|---|---|

| Staking | APY | Moderate | High |

| Lending | APR or APY | Moderate | Medium–High |

| Liquidity Pools | Variable fees | Inconsistent | Medium |

| Yield Optimization | APY | High | Medium–Low |

Understanding the Risks of Passive Income with Crypto ⚠️

No discussion of passive income with crypto is complete without a clear understanding of risk. While staking, lending, and liquidity provision can generate yield, none of these strategies are risk-free. The key difference between successful long-term investors and disappointed ones is not yield selection, but risk awareness and sizing.

Many misconceptions about passive income in crypto come from oversimplified narratives that ignore risk, liquidity, and regulation. If you want to challenge some of the most persistent assumptions, see our overview of common crypto myths investors should stop believing.

🔹 Smart contract risk and protocol security

Most passive crypto strategies rely on smart contracts to manage funds and distribute rewards. While established protocols undergo audits and extensive testing, smart contracts remain software, and software can fail. Audits reduce risk but do not eliminate it, as history has shown through exploits affecting even well-reviewed projects.

Smart contract risk increases as more layers are added to a strategy. Native staking generally carries less contract risk than liquid staking, while yield optimizers introduce additional complexity by interacting with multiple protocols simultaneously. For passive investors, minimizing unnecessary layers is one of the most effective risk controls.

🔹 Slashing risk and validator penalties

In proof-of-stake networks, validators can be penalized for misbehavior or downtime, a process known as slashing. When assets are delegated to a validator, a portion of the stake may be lost if the validator violates network rules.

For large, established networks, slashing events affecting retail participants are rare and usually limited in scope. Liquid staking protocols further spread this risk across multiple validators. Nevertheless, slashing remains a non-zero risk and should be acknowledged as part of any staking-based passive income strategy.

🔹 Liquidity and withdrawal risk

Many passive income strategies involve some form of lockup or delayed withdrawal. Staking often includes an unstaking period, during which assets are inaccessible and do not earn rewards. Lending platforms may impose withdrawal limits during periods of high demand, while liquidity pool positions can be costly to exit during volatile market conditions.

Liquidity risk becomes most visible during market stress, precisely when investors may want flexibility. Passive strategies should therefore be sized with the assumption that funds may not be immediately available at all times.

🔹 Market and price risk

Although passive income with crypto focuses on yield generation rather than trading, it does not eliminate exposure to price movements. Most rewards are paid in crypto assets, meaning income remains tied to market volatility.

Even stable-looking strategies can experience drawdowns if the underlying asset declines significantly. Passive income should be viewed as a supplement to long-term exposure, not as insulation from market risk.

🔹 Regulatory and platform risk for US investors

Regulatory risk plays a particularly important role for US-based investors. Centralized platforms may be forced to suspend or modify staking and lending services due to regulatory actions, as has occurred in previous enforcement cases. This can result in sudden changes to product availability or forced exits.

Decentralized protocols reduce reliance on intermediaries but do not eliminate regulatory uncertainty. Changes in policy, taxation, or enforcement priorities can affect access, reporting obligations, and overall strategy viability. For long-term planning, regulatory risk should be treated as structural rather than hypothetical.

🔹 Why diversification matters in passive strategies

No single passive income method should be treated as risk-free or dominant. Diversifying across staking, lending, and limited exposure to liquidity pools can reduce reliance on any one mechanism or platform.

Equally important is platform diversification. Splitting allocations across multiple reputable protocols can limit the impact of isolated failures and improve overall resilience.

| Risk Type | Affects | Can Be Reduced By |

|---|---|---|

| Smart Contract Risk | DeFi protocols | Using established platforms, fewer layers |

| Slashing Risk | Staking | Validator diversification, liquid staking |

| Liquidity Risk | Staking, lending, LPs | Conservative sizing, planning horizons |

| Market Risk | All strategies | Long-term perspective, allocation discipline |

| Regulatory Risk | CEX, some DeFi | Jurisdiction awareness, flexibility |

Taxes and Legal Considerations for Passive Income with Crypto in the US 🇺🇸

For US investors, taxes and regulation are a critical part of any passive income with crypto strategy. By 2026, the regulatory framework has moved from policy design to implementation, with standardized reporting and clearer treatment of most digital asset activities. Understanding how income is classified and reported is essential for evaluating real after-tax returns.

🔹 How staking and lending rewards are taxed

In the United States, rewards earned from crypto staking and lending are generally treated as ordinary income at the moment they are received or become accessible, according to current IRS guidance on virtual currencies. These rewards are taxed at the investor’s marginal income tax rate rather than at capital gains rates.

The taxable amount is determined based on the fair market value of the rewards in US dollars at the time of receipt. If the rewarded tokens are later sold or exchanged, a separate capital gains or losses event occurs based on the price difference between receipt and disposition.

🔹 Income tax vs capital gains in practice

Income tax applies when staking or lending rewards are earned. Capital gains tax applies when crypto assets are sold or exchanged. If rewarded assets are held for more than one year after receipt, any appreciation may qualify for long-term capital gains treatment.

This separation between income at receipt and gains at sale is a core principle of US digital asset taxation and remains unchanged in 2026.

🔹 Form 1099-DA and broker reporting in 2026

Beginning with the 2026 tax year, US brokers are required to report digital asset transactions using Form 1099-DA (Digital Asset Proceeds from Broker Transactions). This form standardizes reporting of gross proceeds and, for certain assets, cost basis information.

Digital assets acquired through custodial brokers on or after January 1, 2026 are generally considered covered assets, meaning brokers must report both proceeds and basis. By contrast, assets acquired through staking rewards, mining, self-custody, or decentralized protocols are typically classified as noncovered digital assets.

For noncovered assets, brokers may report proceeds but are not required to report cost basis information. As a result, accurate recordkeeping remains the responsibility of the investor.

🔹 Liquidity pools and complex tax events

Liquidity provision introduces additional tax complexity. Trading fees earned through liquidity pools are generally treated as ordinary income. Adding or removing liquidity may also trigger capital gains events, depending on transaction structure.

Modern liquidity protocols often involve frequent internal balance adjustments and multi-asset interactions, which can significantly increase reporting complexity compared to staking or lending strategies.

🔹 Regulatory considerations for US investors

Regulatory clarity around staking improved in 2025, when SEC staff statements clarified that certain staking activities, including staking-as-a-service, are not securities transactions. This reduced legal uncertainty for compliant staking providers and US investors.

However, regulatory risk has not disappeared entirely. Changes in reporting requirements, broker obligations, or enforcement priorities can still affect how passive income strategies are accessed and reported. Long-term investors should treat regulatory considerations as structural rather than temporary.

🔹 A practical, tax-aware approach to passive crypto income

A conservative approach to passive income with crypto involves planning for taxes from the outset, favoring simpler strategies with clearer reporting, and limiting unnecessary transaction complexity. Because many rewards and DeFi-acquired assets are classified as noncovered, investors should assume responsibility for tracking cost basis where brokers cannot.

For most investors, clarity, consistency, and compliance matter more than aggressive optimization when building sustainable passive income strategies.

| Activity | Typical Tax Treatment | Reporting Complexity |

|---|---|---|

| Staking Rewards | Ordinary income | Medium (noncovered assets) |

| Lending Interest | Ordinary income | Low |

| Liquidity Pool Fees | Ordinary income | Medium |

| LP Entry or Exit | Capital gains possible | High |

| Token Sale (covered assets) | Capital gains or losses | Low / automated |

Passive Income with Crypto vs Traditional Finance 📊

To properly evaluate passive income with crypto, it is important to compare it with traditional income-generating investments that US investors already understand. Without this context, crypto yields can appear either unrealistically attractive or unnecessarily risky.

In traditional finance, passive income is most commonly associated with dividend-paying equities and government-backed fixed-income instruments. Each serves a different role in a long-term portfolio, just as crypto-based income strategies do.

🔹 Crypto staking vs S&P 500 dividends

Dividend-focused equity investments, such as those tracking the S&P 500, historically generate an average annual return of approximately seven to ten percent when price appreciation and dividends are combined. However, dividend yield alone is typically much lower, often in the range of one and a half to two percent annually.

Crypto staking differs in structure. Staking yields are paid directly by the network and are independent of price appreciation. While staking returns are generally lower than long-term equity returns, typically between three and six percent, they do not rely on corporate earnings or dividend policies. Instead, staking acts as a yield layer on top of an asset already held for long-term exposure.

From a risk perspective, equities carry business and market risk, while staking carries protocol, liquidity, and regulatory risk. Neither can be considered inherently safer; they simply expose investors to different risk sources.

🔹 Crypto passive income vs US Treasury Bills

US Treasury Bills are often viewed as the benchmark for low-risk income. In recent years, short-term T-Bills have offered yields in the range of four to five percent, backed by the full faith and credit of the US government. These instruments provide capital preservation, predictable returns, and high liquidity.

Crypto passive income strategies may offer similar or slightly higher nominal yields, but they lack government guarantees and introduce volatility, smart contract risk, and regulatory uncertainty. Unlike T-Bills, crypto yields are paid in digital assets whose value can fluctuate significantly over time.

As a result, crypto passive income should not be compared directly to government-backed instruments. Instead, it functions as a higher-risk yield component suited for investors willing to accept variability in exchange for long-term exposure to digital assets.

🔹 Where crypto passive income fits in a diversified portfolio

Traditional finance instruments excel at capital stability and regulatory clarity. Crypto passive income strategies, by contrast, offer yield enhancement within a high-growth, high-volatility asset class. For many investors, the most rational approach is not choosing one over the other, but allocating across both based on risk tolerance and investment horizon.

Beyond equities and bonds, some investors look to real-world assets tokenized on blockchains as a diversification layer. Tokenized gold is one such example, combining physical backing with on-chain settlement. We explore this category in detail in our guide to tokenized gold and real-world assets.

Crypto passive income works best as a complement to traditional investments rather than a replacement. When sized appropriately, staking and conservative lending can enhance overall portfolio yield without undermining diversification principles.

| Asset Type | Typical Yield | Capital Stability | Regulatory Clarity |

|---|---|---|---|

| S&P 500 Dividends | Low | Medium | High |

| US Treasury Bills | Medium | High | Very High |

| Crypto Staking | Medium | Low–Medium | Medium |

| Crypto Lending | Medium | Low–Medium | Medium |

Passive Income with Crypto — Final Thoughts 🧩

Passive income with crypto in 2026 is no longer about chasing extreme yields or experimental protocols. For long-term investors, especially in the United States, sustainable crypto income is built on a narrow set of well-understood mechanisms: staking, conservative lending, and carefully selected liquidity strategies.

The most important insight is that crypto passive income is not a replacement for risk-free savings or guaranteed bonds. It is a yield-enhancement layer applied to assets an investor already intends to hold over long periods. When treated this way, staking and lending can complement traditional portfolios, while liquidity pools and yield optimization require more experience and active risk management.

Successful passive strategies share common traits: realistic return expectations, clear understanding of liquidity constraints, disciplined sizing, and proactive tax awareness. Investors who focus on simplicity, transparency, and diversification are far more likely to benefit from passive income with crypto than those chasing short-term incentives.

Passive Income with Crypto — Frequently Asked Questions ❓

🔹 Is passive income with crypto taxable in the US?

Yes. In the United States, most forms of passive income with crypto are taxable. Staking rewards, lending interest, and liquidity pool fees are generally treated as ordinary income at the time they are received. If the assets are later sold, capital gains or losses may also apply.

🔹 What is the safest way to earn passive income with crypto?

The safest approaches are typically native or liquid staking on major proof-of-stake networks and conservative lending on established platforms. These strategies rely on protocol-level mechanics rather than speculative incentives and tend to have more predictable risk profiles.

🔹 Can I lose my principal investment?

Yes. While passive strategies reduce the need for active trading, they do not eliminate risk. Smart contract failures, market downturns, liquidity constraints, and regulatory changes can all impact capital. Passive income strategies should be sized with the understanding that losses are possible.

🔹 Is staking safer than crypto lending?

Staking and lending carry different risks rather than one being universally safer. Staking primarily involves network and liquidity risks, while lending adds exposure to market stress and protocol mechanics. For many investors, staking is simpler and more predictable, while lending requires closer attention to market conditions.

🔹 How much capital do I need to start earning passive crypto income?

There is no strict minimum, but smaller allocations may produce negligible returns after fees and taxes. Passive income strategies become more meaningful when applied to capital intended for long-term holding rather than short-term experimentation.

🔹 Are trading bots considered passive income?

No. Trading bots automate execution but still rely on active trading strategies, market timing, and drawdown management. They belong to active or semi-active trading, not true passive income, and should be evaluated separately.

🔹 How does crypto passive income compare to traditional investments?

Compared to traditional instruments like US Treasury bills or dividend-paying stocks, crypto passive income typically offers higher potential yields but comes with higher volatility and risk. It is best viewed as a complementary allocation rather than a replacement for traditional income-focused investments.