How to Earn with Liquid Staking: A Step-by-Step Guide for Beginners

If you’re wondering how to earn with liquid staking, the answer is surprisingly simple. Instead of leaving your crypto idle, you can use it to help secure a blockchain network and get rewarded in return. The process is straightforward: you deposit your cryptocurrency into a liquid staking protocol and receive a new token-a liquid staking token (LST)-in exchange. This LST automatically accrues rewards over time, giving you steady yields directly in the original cryptocurrency while keeping your funds liquid. For example, by swapping ETH for wstETH on a platform like Lido, you begin to earn rewards immediately as the value of your wstETH increases against ETH. In this guide, we’ll walk through this and other concrete examples, then explore alternatives across other networks and explain the economics behind where these rewards come from.

👉 See also: How to Earn Passive Income with JLP Jupiter Solana

Table of Contents:

- 🪙 How to Earn with ETH + Lido on Arbitrum (Step by Step)

- 🔄 Alternatives to Lido on Arbitrum

- 💡 The Economics of Liquid Staking

- ❓ FAQ on Liquid Staking

How to Earn with ETH + Lido on Arbitrum (Step by Step)

In this section we’ll look at a specific, practical example: how to stake Ethereum using the Lido protocol on the Arbitrum network. This is one of the simplest ways to start with liquid staking - low fees, a reliable protocol, and rewards that accrue automatically. Step by step, you’ll see exactly what to prepare, what to click, and what results to expect.

🛠 What you need first

- 🦊 MetaMask (or another EVM wallet)

- 🌉 Arbitrum One network added in MetaMask

- 💰 ETH on Arbitrum (withdraw straight from an exchange or bridge from Ethereum mainnet)

- ⛽ A tiny ETH buffer for gas (Arbitrum fees are just a few cents)

👉 Steps (from zero to earning)

-

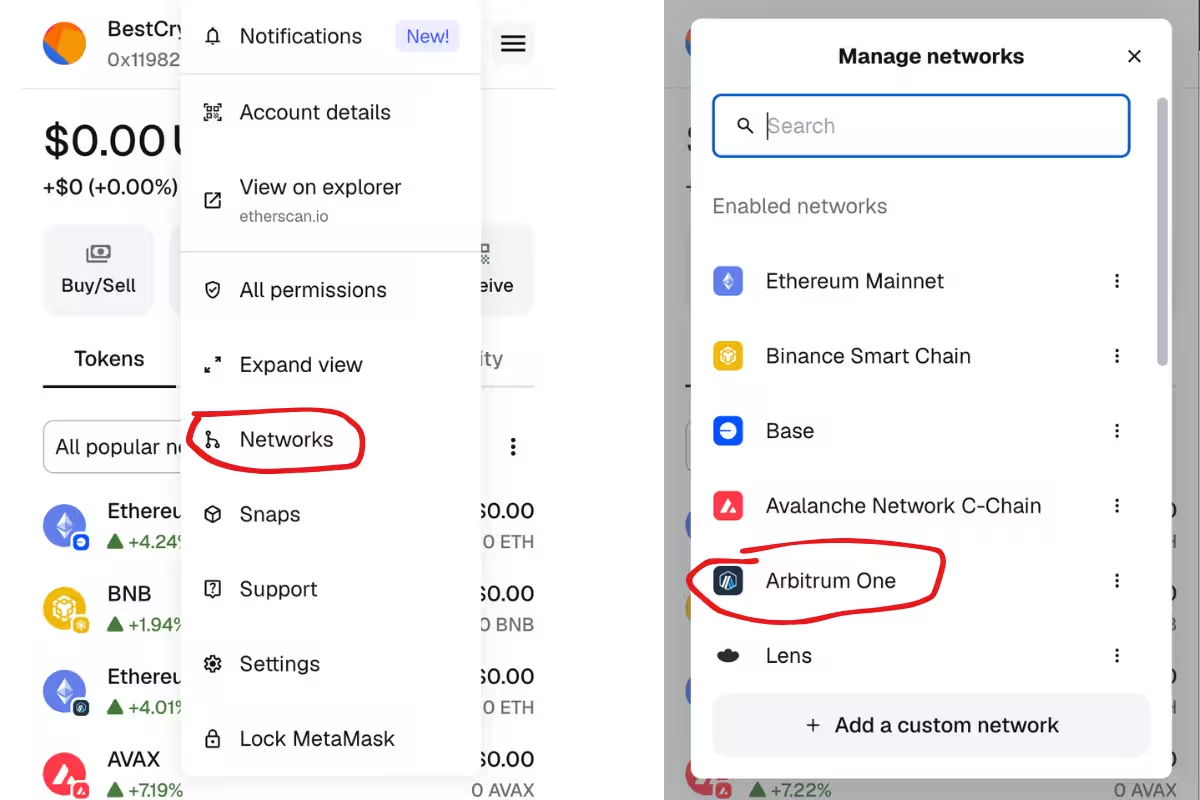

1️⃣ Add Arbitrum One to MetaMask → set it as the active network

In MetaMask open “Networks” → “Add network” and choose Arbitrum One. This is where you will stake ETH because fees are much lower than on the Ethereum mainnet.

-

2️⃣ Get ETH on Arbitrum

Deposit ETH into your wallet on Arbitrum. The easiest way is to withdraw directly to Arbitrum from an exchange (Binance, Bybit, OKX). If your ETH is still on Ethereum mainnet, you can use the official Arbitrum bridge to move it across. -

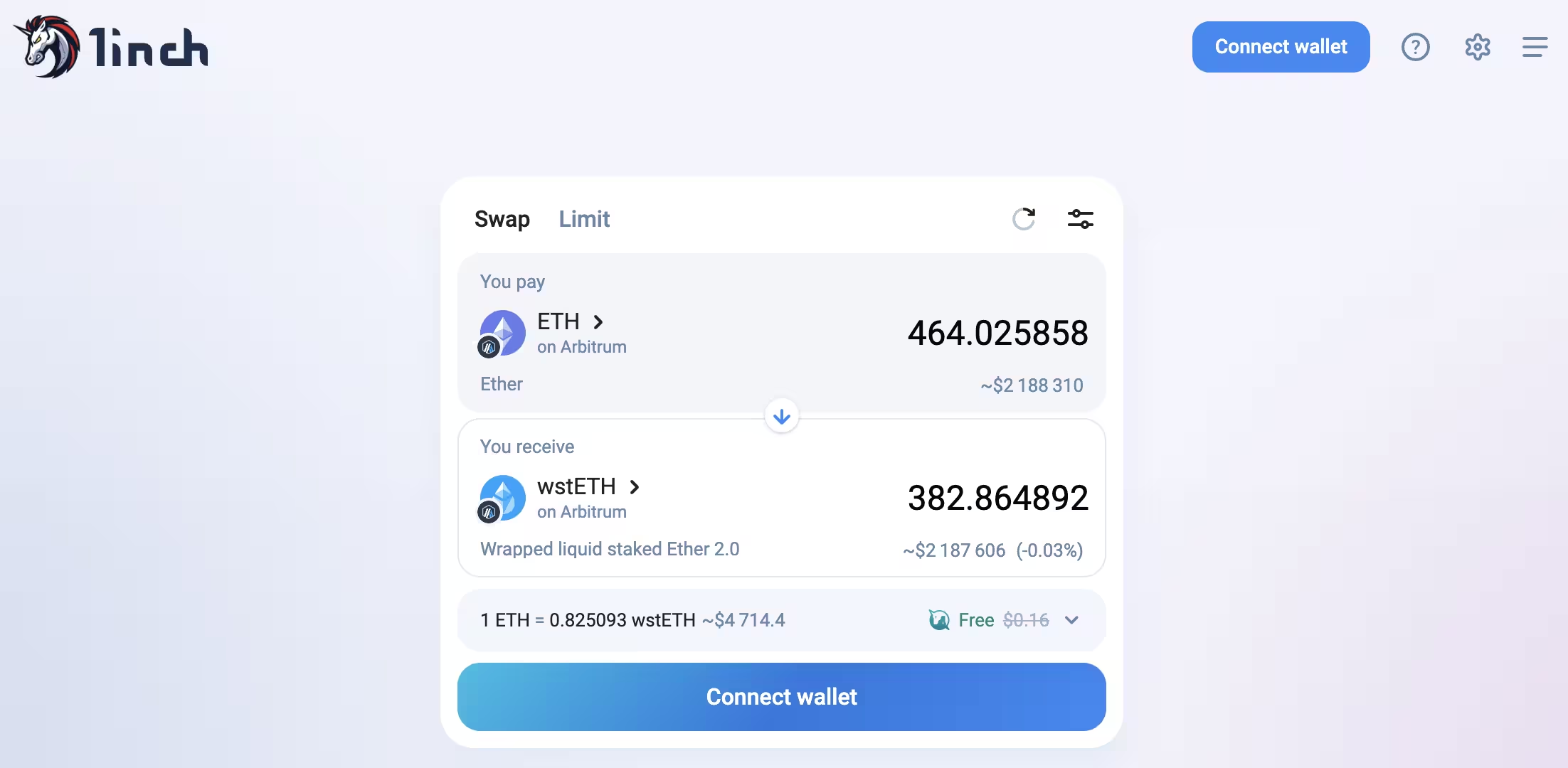

3️⃣ Swap ETH → wstETH

Go to 1inch or Uniswap, connect wallet and choose the Arbitrum network. Select ETH → wstETH, review the fee and confirm the transaction in MetaMask. Important: always verify that you are using the official Lido contract for wstETH on Arbitrum. screenshot app.1inch.io

screenshot app.1inch.io -

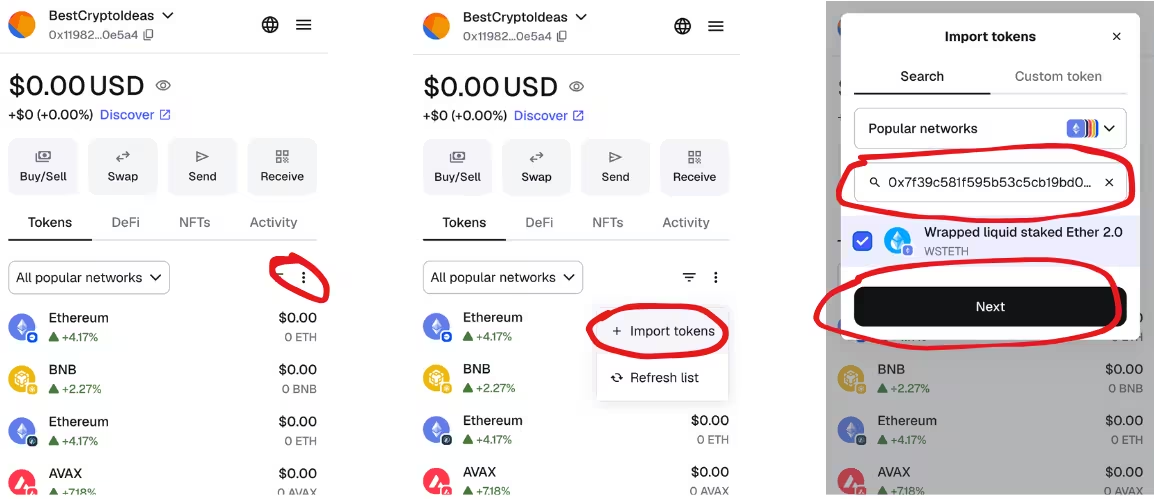

4️⃣ Add wstETH to your wallet (so you see the balance in MetaMask)

After the swap, add the token contract address so that your new balance is visible in the wallet. This makes it easier to track your holdings.

Official contract address of wstETH on Arbitrum: 0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0

-

5️⃣ Hold wstETH to earn

At this point you don’t need to do anything else. The staking rewards are built into the token itself: the exchange rate of wstETH to ETH gradually increases. That means when you later swap wstETH back to ETH, you will receive more ETH than you originally staked. -

6️⃣ Track your rewards

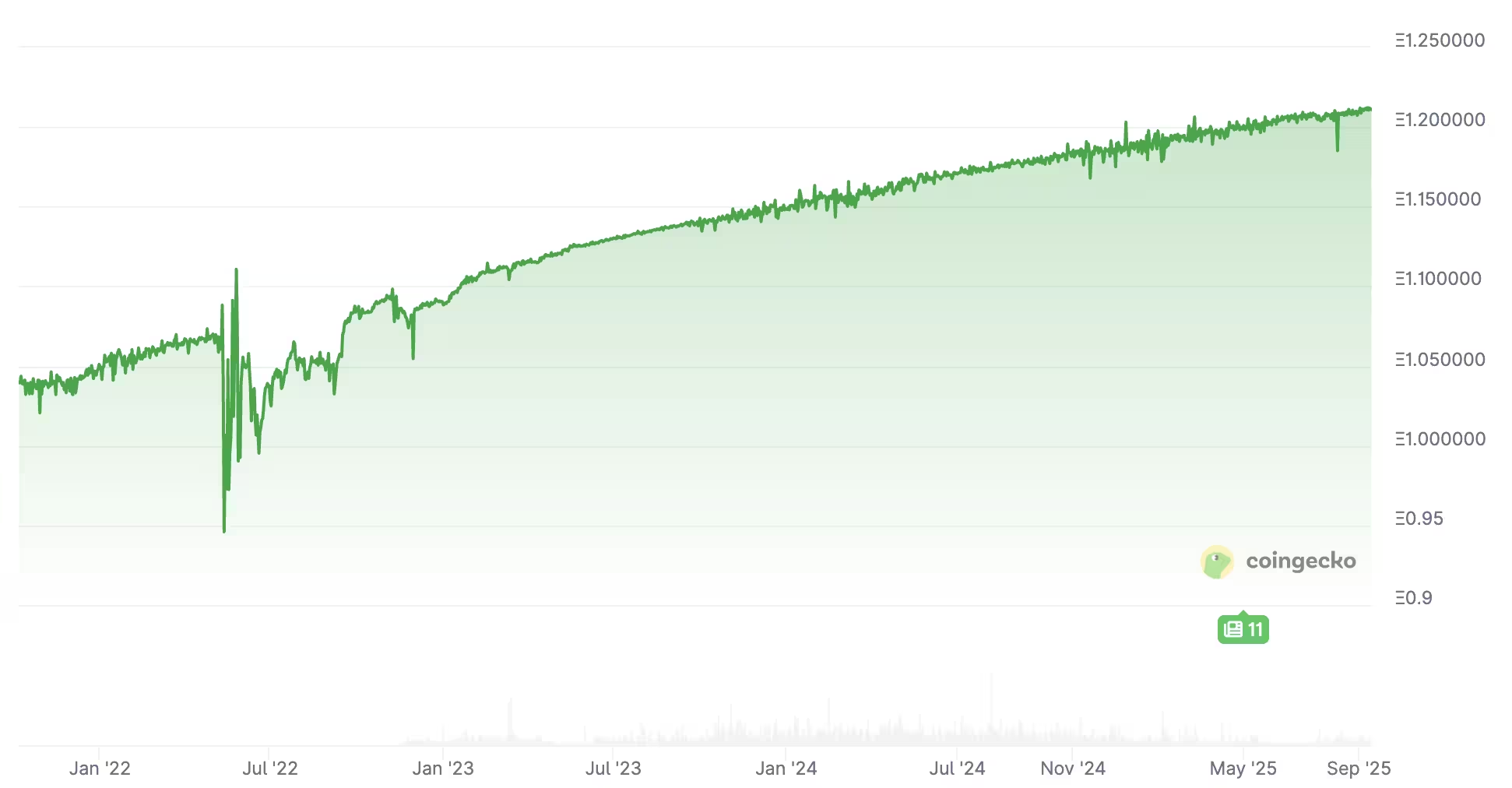

To monitor how your staking position is performing, use these sources: CoinGecko: wstETH price in USD - track the dollar value of your holdings. CoinGecko: wstETH price in ETH - shows the wstETH ↔ ETH exchange rate, the key metric to see how your staking rewards are growing directly in ETH terms. screenshot coingecko.com

screenshot coingecko.com -

7️⃣ Exit anytime

When you want to stop staking, simply swap your wstETH back to ETH on a DEX in Arbitrum. For larger amounts you can also use the official “unstake” function on Lido, but this requires bridging assets back to Ethereum mainnet and usually costs more in fees.

📈 Expected Yields and Risks

Staking ETH through Lido usually pays around 3–4% APR, always in ETH. That means your balance grows in ETH terms over time. In the short run, your dollar value will move with the ETH price. For example, staking 1 ETH at $2,000 with 3.5% APR gives you ~1.035 ETH after a year. If ETH stays at $2,000, that’s $2,070. If ETH rises to $3,000, it becomes $3,105. If ETH drops to $1,500, it’s $1,552.

The main benefit is long-term: if ETH appreciates in USD, your actual dollar yield can be much higher than the base 3–4%. Risks include ETH price volatility, temporary depeg of wstETH from ETH during stress, and potential (though small) smart contract vulnerabilities. In extreme markets, liquidity may also tighten, making large exits slower or more costly.

🔄 Alternatives to Lido on Arbitrum

The example with ETH + Lido on Arbitrum is just one of the easiest ways to start liquid staking. We used Arbitrum because it’s a Layer-2 on Ethereum with very low fees compared to mainnet. But there are many other networks and protocols that also offer liquid staking with different tokens and yields.

🟣 Ethereum-based options

Ethereum also has several liquid staking protocols besides Lido. The most common examples are:

- Rocket Pool (rETH): decentralized alternative, ~3–4% APR.

- Binance staked ETH (BETH / WBETH): centralized exchange option, typically around 2–4% APR.

- StakeWise (osETH): rewards built into token exchange rate, ~3% APR.

🔵 Solana

Solana is a standalone high-speed blockchain, not a Layer-2. It offers higher yields compared to Ethereum because of its inflation-based reward model. The most popular liquid staking options are Marinade (mSOL) and Jito (jitoSOL), both giving around 6–7% APR. Jito additionally shares a portion of MEV rewards with stakers, which slightly increases the overall yield compared to standard staking.

🔺 Avalanche

Avalanche is an independent Layer-1 blockchain focused on scalability and the use of subnets. Liquid staking here allows AVAX holders to keep liquidity while earning rewards. The most common option is Benqi (sAVAX), where the token gradually increases in value compared to AVAX, with yields usually around 5–7% APR. Another alternative is Yield Yak, which offers auto-compounding strategies for staked AVAX, but it is more complex and involves additional smart contract risk.

🌌 Cosmos

Cosmos is a network of independent blockchains connected through the IBC protocol. Staking yields here are higher because the ATOM token has a built-in inflation model. The main liquid staking options are Stride (stATOM) and Stader (stkATOM), where the token value increases against ATOM. Typical yields are in the range of 15–20% APR, but with higher risk due to inflation and the relative youth of the ecosystem.

🟣 Polygon

Polygon is a Layer-2/sidechain solution that scales Ethereum and reduces transaction costs. In this network, liquid staking is available through Lido (stMATIC) and Stader (MATICx). Both tokens grow in value compared to MATIC, with yields usually around 4–6% APR. This option is popular for those who want exposure to Ethereum’s ecosystem with much lower fees.

For those who want to explore further, a full list of liquid staking protocols across different networks is available on DefiLlama’s liquid staking dashboard. This resource is updated in real time and shows yields, TVL, and supported chains, making it easier to compare options beyond the examples listed above.

💡 The Economics of Liquid Staking

To understand why liquid staking generates income, it’s important to look at how blockchains like Ethereum or Solana actually work. These networks rely on validators - computers that process transactions and keep the chain secure. For their work, validators receive rewards, and liquid staking lets regular users like you participate in sharing those rewards.

Here are the main sources of income:

- Transaction fees. Every time someone makes a transfer, swaps tokens, or interacts with a smart contract, they pay a small fee in the network’s native coin. Part of these fees goes directly to validators.

- New token issuance. Many blockchains create (or “mint”) a controlled number of new tokens as an incentive for validators. These newly created tokens are also shared with stakers.

- MEV (Maximal Extractable Value). In some chains, validators can earn extra by optimizing the order of transactions in a block - for example, capturing arbitrage opportunities. In some protocols (like Jito on Solana), part of this MEV profit is shared with liquid staking participants.

How liquid staking protocols distribute rewards:

- Protocols like Lido, Rocket Pool, or Benqi gather funds from thousands of users and delegate them to professional validator operators.

- Validators earn fees, block rewards, and sometimes MEV income.

- A small commission (often 5–10%) is kept by the protocol to cover infrastructure and development.

- The rest is distributed back to users, either by increasing the value of the liquid staking token (like wstETH → ETH) or by gradually adding balance (like stETH).

This means your yield comes from real economic activity in the blockchain itself: securing the network, confirming transactions, and keeping it decentralized. You are effectively lending your coins to the network so it can keep running safely, and in return, the network pays you part of the rewards.

Unlike financial pyramids, where profits depend only on new deposits, staking income does not require new participants. Rewards exist because the blockchain always generates fees and incentives to function. This makes liquid staking one of the most transparent and sustainable ways of earning passive income in crypto.

❓ FAQ on Liquid Staking

What is liquid staking in simple terms?

Liquid staking is when you deposit your cryptocurrency (for example, ETH) into a staking protocol that secures the blockchain. In return, you receive a special token (called an LST, like wstETH), which represents your staked coins. This token grows in value or increases your balance over time, so you earn rewards while still keeping the flexibility to trade or use the token in DeFi.

How do I actually earn money with liquid staking?

When you stake, your coins are delegated to validators - computers that process transactions and secure the blockchain. Validators receive rewards from transaction fees, new token issuance, and sometimes extra revenue (like MEV). These rewards are collected by the staking protocol, minus a small fee, and then distributed back to you. The result: the liquid staking token you hold is worth more and more compared to the original coin, giving you passive income.

What is the expected yield and in what currency do I receive it?

Most liquid staking protocols on Ethereum (like Lido or Rocket Pool) currently pay about 3–4% per year. The important detail is that rewards are always in the native cryptocurrency, not in dollars. For example, if you stake ETH, you receive more ETH over time. The dollar value of your rewards depends on the market price of ETH: if ETH grows, your dollar profit can be much higher; if ETH falls, your dollar value can shrink even though your ETH balance has increased.

Is liquid staking safe?

Liquid staking is considered relatively safe compared to many other DeFi strategies, but it still carries risks. The main risks are smart contract vulnerabilities, temporary depegs (when the staking token trades below the value of the original coin), and volatility in the coin’s dollar price. Large and audited protocols like Lido and Rocket Pool are generally trusted, but no protocol is risk-free.

Can I withdraw my money anytime?

Yes, you can usually exchange your liquid staking token (like wstETH) back into the original coin (ETH) at any time using decentralized exchanges on the same network. Some protocols also allow direct unstaking, but this may take several days and sometimes requires bridging back to Ethereum mainnet, which is more expensive. For everyday users, simply swapping the token back on a DEX is the easiest option.

How is this different from a financial pyramid?

A financial pyramid depends on constant new deposits from new participants to pay older ones. Liquid staking works differently: the rewards are generated by the blockchain itself through transaction fees, issuance of new tokens, and validator operations. Even if no new users join, the blockchain continues to function and generate rewards. That’s why liquid staking is considered a sustainable form of passive income rather than a pyramid scheme.

Which tokens can I stake besides Ethereum?

Ethereum is the most common starting point, but there are many other options. On Solana you can stake through Marinade (mSOL) or Jito (jitoSOL); on Avalanche you can use Benqi (sAVAX); in Cosmos you have Stride (stATOM) or Stader (stkATOM); and on Polygon you can stake MATIC via Lido or Stader. Each of these has its own yield levels, usually higher than Ethereum, but often with higher risks.