How to Earn Passive Income with JLP Jupiter Solana

JLP is the Jupiter Liquidity Provider token on Solana that gives investors exposure to a pool of SOL, ETH, WBTC and USDC while earning trading-fee revenue from Jupiter Perpetuals. Its value grows from both the performance of these assets and the fees and liquidations generated when traders open leveraged positions. Buying and holding JLP on the Jupiter platform provides a hands-off way to earn passive income, with historical yields often reaching double-digit APR, though market volatility and DeFi risks remain. For higher potential returns, experienced users can also apply a looping strategy-borrowing against JLP to buy more and compounding their passive income.

For a broader, risk-aware overview of passive income strategies before diving into DeFi, see Passive Income with Crypto — A Practical Guide for Long-Term Investors.

JLP has shown a steady upward trend in its USDC value - you can verify this on CoinMarketCap where a live price chart is available.

Table of Contents:

- 📈 What Is the JLP Token

- 💰 How JLP Generates Income

- 🛒 How to Get JLP

- 🚀🔄 Boosting JLP Returns with a Looping Strategy

What Is the JLP Token 📈

The Jupiter Liquidity Provider (JLP) token represents a share of a fixed-composition liquidity pool on Jupiter’s Perpetuals (Perps) platform. This pool is the source of leverage for Perps traders-it provides the assets that traders borrow when opening leveraged long or short positions.

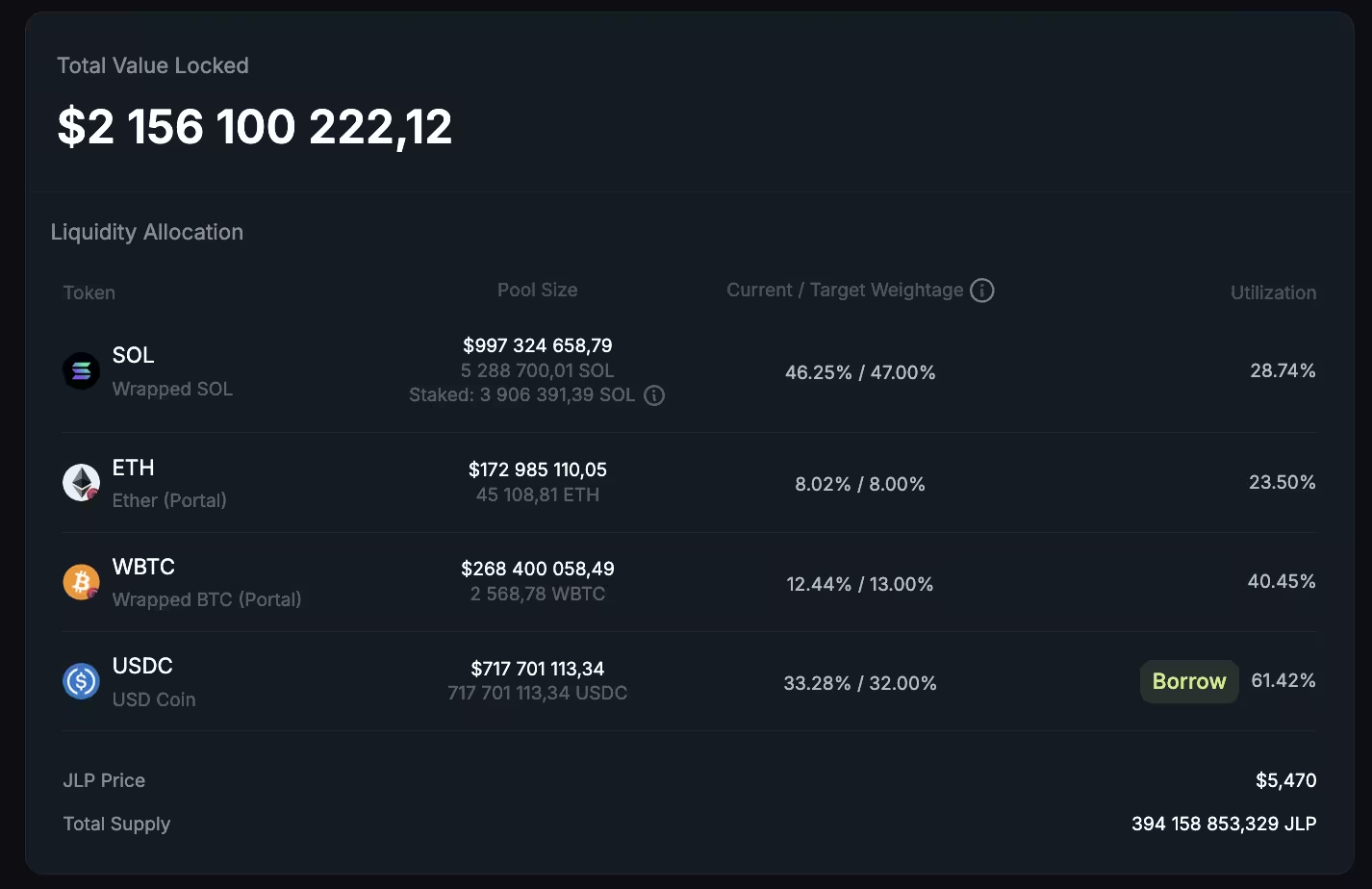

The pool consistently holds SOL (wrapped SOL), ETH (Portal), WBTC (Portal), and USDC. While the target allocations are stable, the current percentages shift dynamically with market flows. For example, at the time of writing, the pool distribution was approximately 46 % SOL, 8 % ETH, 12 % WBTC, and 33 % USDC (see snapshot).

You can always check the latest pool composition and JLP token price on the official Jupiter Earn page.

How JLP Generates Income 💰

Trading Fees from Jupiter Perps

The largest and most predictable revenue stream for JLP holders is the share of trading fees collected on the Jupiter Perpetuals platform. JLP token holders receive about 75 % of all Perps fees. Standard swap fees from Jupiter’s DEX aggregator are not shared with JLP holders. JLP income comes only from the Perpetuals (Perps) platform and the activity of leveraged traders:

- Opening and closing fees – paid whenever a trader opens or closes a leveraged position.

- Borrow (funding) fees – interest charged to traders who borrow assets from the JLP pool when using leverage.

These fees are automatically credited to the liquidity pool and raise the value of every JLP token.

For those exploring other passive income options in DeFi, you can also look into liquid staking - a strategy that allows you to earn staking rewards while keeping your assets tradable and liquid. 👉 See also: How to Earn with Liquid Staking: A Step-by-Step Guide for Beginners

Liquidation Proceeds

When a trader’s leveraged position is liquidated, the pool collects liquidation fees and any remaining collateral JLP Economics – Jupiter Exchange. This extra income flows back into the pool and increases the net asset value (NAV) of each JLP token. The JLP pool acts as the counterparty to all Perps trades. If traders as a group lose money-which historically happens more often than not-those losses become direct profit for the pool. Over time this “house edge” effect strengthens JLP’s long-term growth.

All trading fees, liquidation proceeds and trader losses are reinvested directly into the JLP pool. This automatically raises the NAV, so the price of every JLP token grows-your passive income shows up as the token’s increasing market value rather than separate payouts.

Appreciation of Underlying Assets

JLP also mirrors the market value of its underlying assets-SOL, ETH, WBTC and USDC. When SOL, ETH or WBTC rise in price, the value of each JLP token rises proportionally. About one-third of the pool is USDC, helping to smooth out volatility compared with holding only volatile coins.

Note: Roughly half of the portfolio is Solana (SOL), while ETH and BTC together make up only about 20 %. This means that the growth or decline of JLP’s value is driven much more by Solana’s performance than by the more popular BTC or ETH. Investors should factor this into their portfolio strategy, recognising the higher weight on Solana. At the same time, Solana is widely regarded as a high-potential network, offering very fast and extremely low-cost transactions, which many analysts believe gives it a strong long-term outlook.

How to Get JLP 🛒

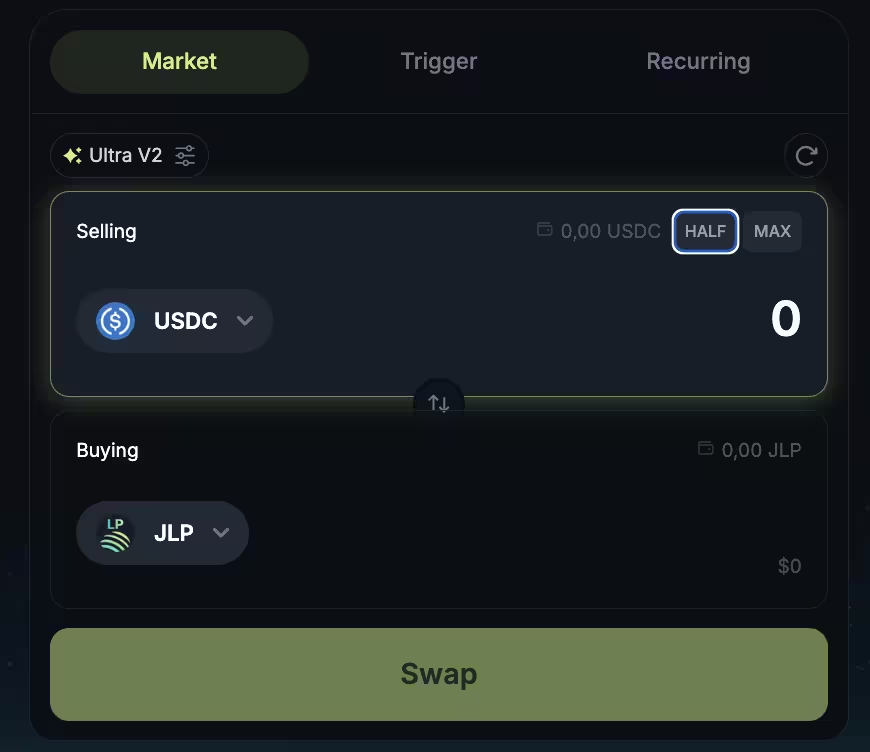

- Open the JLP swap page on jup.ag/swap.

- Connect your Solana wallet (for example Phantom or Solflare) so Jupiter can send the tokens to you.

- Pick the coin you want to exchange-most often USDC-while JLP stays selected as the token you’re buying.

- Type in the amount you wish to convert and check how much JLP you’ll receive.

- Press “Swap” and approve the transaction in your wallet window.

After a few seconds the swap is complete and the newly minted JLP tokens will show up in your wallet, making you a liquidity provider on Jupiter’s Perps platform.

You can always check the current JLP price on the official Earn page.

For easier tracking of your results, it’s recommended to note or save the price (or average price) at which you bought your JLP tokens. This will help you clearly see how much your investment has grown and calculate your actual profit over time.

Boosting JLP Returns with a Looping Strategy 🚀 🔄

For JLP holders who want to go beyond a simple buy-and-hold approach, looping can amplify potential gains. This DeFi technique uses JLP as collateral to borrow stablecoins, buy more JLP, and repeat the cycle-effectively creating controlled leverage.

Because the JLP pool contains a significant share of stablecoins, its price fluctuations are typically smoother than those of single crypto assets, which makes this strategy somewhat easier to manage for experienced users willing to accept higher risk.

Example: Looping on save.finance

Let’s look at how the process works using the JLP Pool on save.finance:

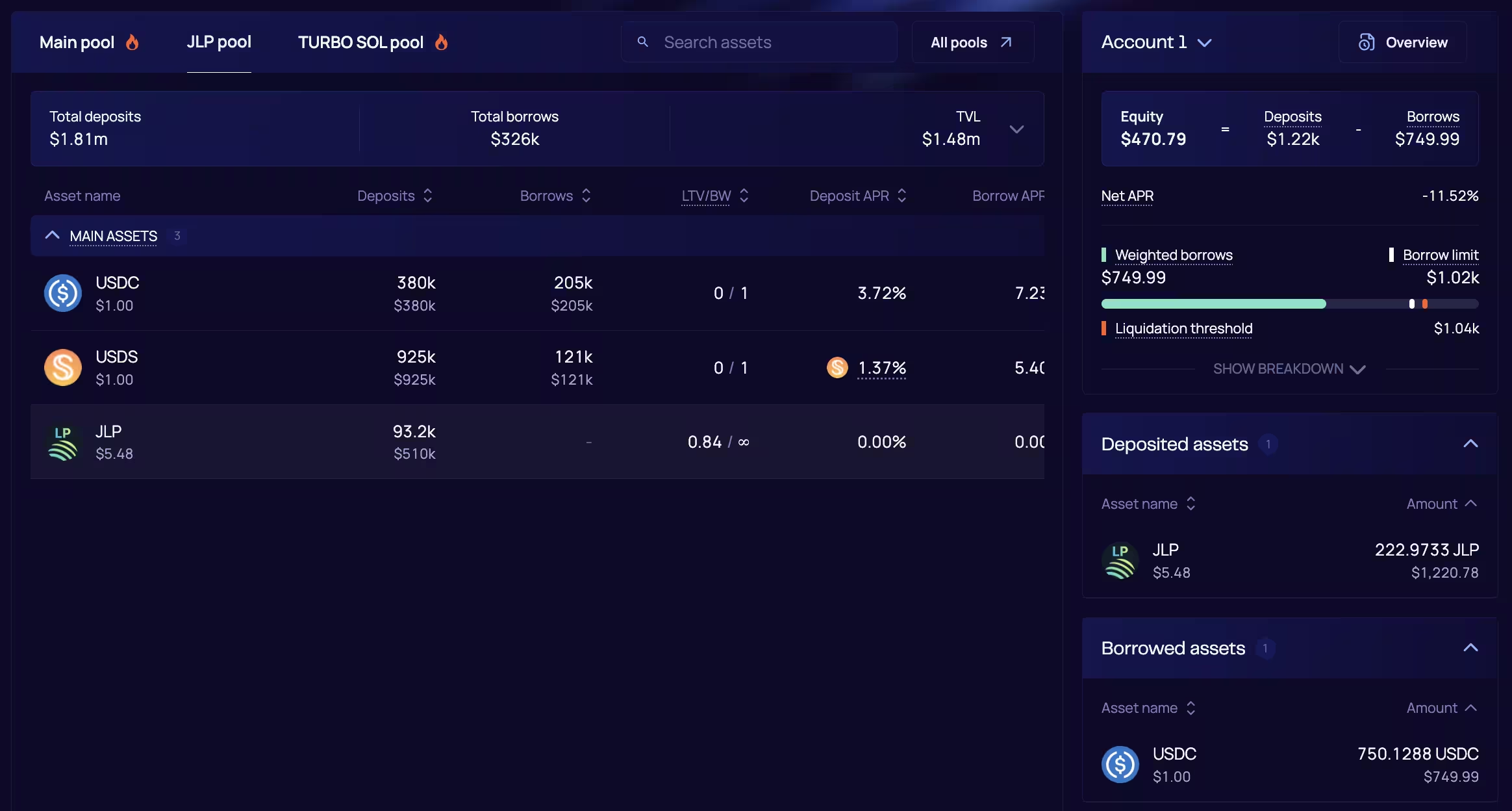

- Deposit JLP as collateral in the save.finance JLP Pool.

- Borrow USDC or USDT against your deposited JLP.

- Use the borrowed stablecoins to buy more JLP on jup.ag/perps/jlp-earn.

- Repeat the cycle: re-deposit the newly purchased JLP as collateral and borrow again to increase your position.

This looping strategy allows you to hold more JLP tokens than your initial capital would normally buy, so when the JLP price rises the total value of your holdings grows faster than the market. A practical way to apply it is to start new loops when the price dips-borrow stablecoins and purchase extra JLP at the lower price-then repay the borrowed USDC or USDT once the price rebounds. Because the tokens you bought earlier have appreciated, you can close the debt and keep a larger JLP balance than you began with, which enables you to outperform a simple buy-and-hold approach.

Key Risks

The main risks of this strategy include the possibility of liquidation if the JLP price falls sharply and your collateral ratio drops below the platform’s requirement, which can lead to the forced sale of your JLP. Rising interest rates on the borrowed USDC or USDT can also reduce your net return. In addition, as with any DeFi protocol, there is always a chance of bugs or exploits in the smart contracts. To reduce these risks you should keep a healthy safety margin well above the minimum collateral level and carefully watch market conditions. Remember that looping magnifies both profits and losses, so it is a strategy for experienced DeFi users only.