Meme coins: real way to earn or just gambling?

Meme coins are ultra-speculative tokens whose prices move mainly on hype, memes, and crowd psychology-not real utility. Platforms like Pump.fun on Solana let anyone launch one in minutes using a bonding-curve price model. While a few coins like Dogecoin and PEPE reached multibillion market caps, many implode or get rug-pulled. Common traps include influencer-driven pump-and-dumps, honeypot contracts, and copy-trading that turns followers into exit liquidity. Basic checks-holder concentration, locked liquidity, contract permissions (mint/freeze), real audits, and authentic community activity-help filter risk, but the math still favors the “house.” Net-net: treat meme coin trading like gambling; only stake what you can afford to lose.

Table of Contents:

- 💡 What Are Meme Coins and How They’re Created

- 🌟 Successful Memes and Their Meteoric Rise

- 💥 When Memes Crash - Failed and Overhyped Tokens

- 🕳️ How Memes Turn Into Traps - Schemes Inside the Meme Coin World

- 🔍 How Traders Hunt for Meme Coins That Might Moon - and Avoid Scams

- 🎰 Meme Coins or Modern Gambling?

Before diving deeper, it’s important to frame the question correctly. Meme coins often blur the line between speculation and pure chance. If you want a clear breakdown of where analysis ends and gambling begins, start with our foundational article:

👉 Meme Coin Gems Guide - How Meme Coins Actually Work

What Are Meme Coins and How They’re Created 💡

Meme coins are cryptocurrencies born from jokes, internet culture, or viral trends rather than technological innovation or utility. Their price depends mostly on hype, social media engagement, and community excitement - not intrinsic value. Unlike Bitcoin or Ethereum, which rely on decentralized infrastructure and clear use cases, meme coins exist as speculative collectibles. They function more like internet phenomena than long-term financial instruments.

In essence, a meme coin’s value is a reflection of collective belief. As long as people think it’s funny, cool, or “going to the moon,” it can attract buyers and rapidly appreciate in price. But once the hype fades, liquidity vanishes just as fast.

👉 Read also: Averaging Down in Crypto

📈 How Their Value Forms

The price of a meme coin is shaped by a mix of social and market dynamics:

- Viral trends on X (Twitter), TikTok, and Reddit that amplify curiosity

- Coordinated community “raids” and influencer promotions

- The fear of missing out (FOMO), which pushes traders to buy early

- Automated liquidity pools that make trading possible even without centralized exchanges

Because there’s no underlying product or revenue, demand itself becomes the engine of price growth. When that demand stops - the engine dies.

🚀 The Rise Of Pump.fun On Solana

Pump.fun, launched in early 2024, revolutionized the way meme coins are born. Built on the Solana blockchain, it allows anyone with a wallet and a few SOL to create a new token within minutes - no coding required.

Process overview:

- Choose a token name, ticker, and upload an image.

- The platform automatically deploys a smart contract with a built-in bonding curve.

- As users buy, the price rises algorithmically; early buyers pay less, later ones more.

- Once the market cap hits around $69,000, the token “graduates” and becomes tradeable on decentralized exchanges like Raydium.

Pump.fun takes a 1% fee on each swap, earning steady revenue regardless of whether a token succeeds or fails. By the start of 2025, the platform had enabled the creation of over six million tokens, processing about 60% of all Solana transactions during peak periods.

A bonding curve is an automated pricing formula used by Pump.fun’s smart contracts. It sets an initial low price and increases it with every new purchase. Each buy slightly raises the next buyer’s price, creating a built-in incentive to “get in early.” When investors later sell, they exit along the same curve - but if buying pressure dries up, sellers face sharp price drops. In other words, Pump.fun’s model gamifies token creation. It transforms speculation into a kind of interactive entertainment where users compete to find “the next DOGE” before everyone else does.

🎯 A New Kind Of Speculation

Platforms like Pump.fun have turned meme-coin trading into a social experience. Creating a coin is as easy as posting a meme, and launching one successfully can feel like winning the lottery. For most users, it’s not about building sustainable projects - it’s about testing luck, timing, and humor in a digital marketplace that rewards virality above all else.

Successful memes and their meteoric rise 🚀

There are plenty of examples of successful meme coins that turned ordinary holders into overnight millionaires. Some of them started as jokes, others as social experiments, yet all shared one key feature - viral community enthusiasm. While only a fraction of these coins survive, their stories show how powerful internet culture can be when it meets financial speculation.

🐶 Dogecoin - the original meme currency

Dogecoin is the first and most iconic meme coin. It was launched in December 2013 by software engineers Billy Markus and Jackson Palmer as a parody of the cryptocurrency craze. The coin used the popular “Doge” meme featuring a Shiba Inu dog with comic sans captions.

For years, Dogecoin existed quietly as a playful online currency used for tipping content creators on Reddit and Twitter. Everything changed in 2021, when Tesla founder Elon Musk began mentioning Dogecoin on social media. Each of his tweets caused wild price spikes - sometimes up to 40% in a day.

In just a few months, Dogecoin’s price surged by more than 15,000%, peaking in May 2021 at around $0.73 per coin. Its total market capitalization briefly exceeded $80 billion, surpassing many established corporations. For early adopters, even a small purchase worth a few hundred dollars in 2020 could have turned into hundreds of thousands a year later. Although the price has since fallen, Dogecoin remains a top-ten cryptocurrency and the cultural blueprint for all later meme coins.

🐕 Shiba Inu - from joke to ecosystem

Created anonymously in August 2020 by a developer known as Ryoshi, Shiba Inu was designed as a “Dogecoin killer.” Despite this tongue-in-cheek mission, SHIB evolved into something much bigger. Its ecosystem now includes the decentralized exchange ShibaSwap, the layer-2 blockchain Shibarium, and its own NFT collections.

In its early months, Shiba Inu traded for a fraction of a cent, but during 2021’s crypto boom, it became one of the fastest-growing assets in history. From launch to its October 2021 peak, SHIB’s price increased by roughly 377,000%. At one point, its market cap exceeded $39 billion - enough to momentarily overtake Dogecoin.

This extreme growth created unbelievable success stories: one investor who bought around $8,000 worth of SHIB in 2020 reportedly saw the value rise to over $5 billion at its peak. While such outcomes are rare, they fuel the legend of meme-coin riches and continue to attract new dreamers to the space.

🐸 Pepe - the frog that went viral

Launched in April 2023, PEPE quickly became the symbol of the next generation of meme coins. It was inspired by the long-standing internet character Pepe the Frog and embraced irony by openly declaring itself “completely useless and for entertainment purposes only.” That honesty didn’t stop it from becoming a sensation.

Within weeks of launch, PEPE’s market cap surpassed $1.5 billion, and at its height in late 2024 it was valued at more than $4 billion. The token’s price skyrocketed by hundreds of millions of percent, transforming a $200 investment at launch into a theoretical fortune worth over $500 million.

Its success stemmed from perfect timing and massive online momentum. Crypto influencers, traders, and even mainstream media amplified the trend. PEPE became a cultural statement - not a project promising innovation, but one mocking the absurdity of speculation itself. Ironically, that honesty made it even more desirable.

🐕 Bonk - Solana’s comeback dog token

While most meme coins originated on Ethereum or BNB Chain, Bonk became the face of Solana’s revival - and another canine addition to the ever-growing family of dog-themed tokens. Launched in December 2022 after Solana’s ecosystem was shaken by the FTX collapse, Bonk aimed to restore community spirit and reward loyal users.

The token featured a cartoon dog mascot and was airdropped to thousands of developers, NFT holders, and active wallets in the Solana ecosystem. The idea was simple: spread fun, rebuild morale, and reignite activity across the network.

Bonk’s launch triggered a rally of more than 4,000% within weeks and helped revive trading volumes on Solana’s decentralized exchanges. By 2024, Bonk had been integrated into over 350 on-chain projects - from NFT collections to Web3 games and DeFi tools. Its market capitalization stabilized near $1.9 billion, proving that even a meme can help bring a blockchain back to life.

🧠 what these examples show

These success stories highlight that meme coins thrive on collective emotion more than fundamentals. Dogecoin and Shiba Inu built lasting communities; PEPE and Bonk rode waves of hype and humor to billions in value. Yet, behind every headline-making winner lie thousands of forgotten tokens that never reached critical mass. For most investors, chasing the next meme miracle is less a strategy and more a gamble - but that’s also what makes this phenomenon so fascinating.

When memes crash: failed and overhyped tokens 💥

While some meme coins make their holders rich, most eventually crash - either because the initial excitement fades or the concept simply can’t sustain long-term value. For every Dogecoin or PEPE, there are dozens of projects that rose quickly and then disappeared almost overnight. Below are several examples that made global headlines before collapsing back to reality.

💣 Squid Game Token - from viral sensation to zero

In late 2021, during the peak popularity of Netflix’s Squid Game, a new token called Squid Game Token (SQUID) appeared on the Binance Smart Chain. It promised an upcoming “play-to-earn” game inspired by the show’s concept, where players could compete for prizes. The idea spread like wildfire across social media - and in just a few days, the price went from a few cents to over $2,800 per token.

The global media covered the story, and thousands of new buyers rushed in. However, soon it became clear that something was wrong: users reported that they could buy SQUID but couldn’t sell it. As panic set in, the token’s price crashed to fractions of a cent within minutes. The official website and social media channels went offline shortly after. The entire episode lasted less than two weeks but became one of the most memorable cautionary tales in crypto history - a symbol of how fast viral fame can turn into digital dust.

🇺🇸 TRUMP and MELANIA - political hype that burned out

In 2024, during a wave of politically themed cryptocurrencies, several tokens using the names TRUMP and MELANIA were launched on different blockchains. They quickly gained attention as the U.S. presidential race intensified, drawing both supporters and critics. The coins saw sharp increases in value, with daily trading volumes reaching millions of dollars, as traders speculated on campaign-related headlines.

But as the political season cooled and new narratives took over, interest in these tokens faded just as quickly as it had appeared. Prices dropped by more than 70% from their peaks, and the once-buzzing communities grew silent. The “political meme-coin era” became a short-lived trend - a reflection of how sentiment-driven these markets really are.

🇦🇷 LIBRA - Argentina’s meme coin rollercoaster

In early 2024, a token called LIBRA emerged in Argentina amid growing excitement around the newly elected president Javier Milei, who had publicly supported libertarian ideas and Bitcoin. Although not officially connected to the government, the coin’s branding and timing led many traders to associate it with Milei’s political image.

The token’s price skyrocketed within days, fueled by local and international investors hoping it might symbolize a new pro-crypto era in Argentina. For a brief moment, LIBRA became one of the most traded meme coins in Latin America. Yet after the initial wave of enthusiasm, trading volumes dried up, and the price fell more than 80%. The token remains a reminder that political excitement can spark quick rallies - but rarely creates lasting value.

🌍 CAR - Central African Republic’s digital dream

The CAR meme coin was launched in 2022 after the Central African Republic made headlines for adopting Bitcoin as legal tender. The coin was marketed as part of a broader push to modernize the country’s image and promote blockchain innovation. For a short period, the token captured attention across African crypto communities, and its price surged during the first weeks of trading.

However, limited infrastructure and unclear communication around its purpose led to a rapid loss of investor interest. Within months, the coin’s value had fallen by more than 90%, and trading activity dwindled to near zero. Despite the early buzz, CAR became another example of how ambitious projects can falter when excitement outpaces practical adoption.

⚠️ lessons from the downtrend

Each of these tokens started with viral energy and strong narratives - popular TV shows, political campaigns, or even national initiatives. But without sustainable utility or ongoing community engagement, their momentum inevitably faded. Meme coins thrive on attention, and once that attention moves elsewhere, even the most talked-about projects can lose nearly all their value in a matter of days.

How memes turn into traps: schemes inside the meme coin world 🕳️

Most meme coins simply fade away when the hype runs out. But sometimes the fall happens by design - through planned exit strategies or manipulative trading setups. Understanding how these patterns work helps to see how easily the energy of memes can be turned into a financial trap.

🪄 Rug pulls - when a meme coin loses the floor

A rug pull happens when the team behind a meme coin removes the liquidity that allows holders to trade. In decentralized markets, every token needs a liquidity pool to swap against another asset like SOL, ETH, or USDC. When this pool is withdrawn, the token effectively becomes untradeable.

It often starts with a community-driven launch and steady price growth. Then, when enough volume accumulates, the liquidity is suddenly pulled, and the coin’s price collapses to zero within seconds. The entire project may vanish - websites closed, social media deleted, and the meme left as a digital ghost.

🔁 Pump-and-dump - when memes inflate too fast

A classic pattern where rapid online promotion creates artificial demand. Dozens of meme accounts and chat groups post identical memes, promising that a new coin is “about to moon.” As traders rush in, the price surges, but once early holders sell, the market crashes just as quickly.

The pump phase feels euphoric - charts vertical, communities shouting slogans, screenshots of huge gains. The dump phase is silent: volume dries up, and newcomers are left holding illiquid coins. Such campaigns rely on coordinated timing and viral momentum rather than long-term utility.

🐝 Honeypots - the meme coin you can buy but never sell

Some meme coins use smart contracts that technically prevent selling. On the surface, the token looks normal: you can buy it, and its price even goes up. But when you try to sell, the transaction fails or you receive nothing.

These contracts often include invisible restrictions - such as transfer limits, whitelists, or 100% sell taxes. To an ordinary buyer, it looks like a system glitch, but it’s actually built into the code. Since many people never read the contract, these traps can stay unnoticed until the damage is done.

🧩 Admin keys and hidden contract control

Even if a meme coin’s contract looks open, it might still be under full control of its deployer. Some tokens have upgradeable contracts or owner privileges that allow changing core parameters: minting new tokens, freezing balances, or redirecting fees.

Ownership can appear “renounced” but in practice just moved to another controlled address. These hidden switches let the deployer change the rules mid-game - for example, raising transaction taxes or disabling sales at will.

💸 Liquidity locks that aren’t really locked

To gain trust, creators often say that liquidity is locked, showing a screenshot from a locker platform. In reality, they may lock only a small fraction of the total liquidity or use their own contracts that can later unlock funds.

True locked liquidity should be visible on-chain, with LP tokens sent to a verifiable locker or a burn address. Anything less than full transparency is a potential signal that the safety is more illusion than reality.

📣 Meme influencers and viral amplification

Influencers play a big role in the life cycle of meme coins. A few well-timed posts or memes from popular accounts can turn a small project into a global trend. But in some cases, the motivation behind the posts isn’t organic enthusiasm but paid promotion or early insider positions.

When audiences start buying based on hype, the price rises - giving promoters a window to exit. Once the attention fades, the community realizes that the momentum was mostly social media fuel. The coin’s story fades with the memes that created it.

🤖 Bots, wash trading and fake volume

Trading bots can simulate activity by repeatedly buying and selling the same token, making it look like a thriving market. High volume attracts new buyers who believe liquidity is real. But when real demand doesn’t appear, prices collapse the moment the artificial activity stops.

On-chain, these manipulations often appear as repeated trades between the same small group of wallets or identical order sizes within seconds. The meme keeps trending, but the numbers behind it are an illusion.

⚡ Front-running and MEV in meme markets

In fast meme markets, even legitimate buyers can lose before they finish a transaction. Specialized bots scan the blockchain mempool for incoming buys and insert their own orders first - a practice known as front-running. They profit from the small price difference created by your own trade.

These MEV (Maximal Extractable Value) bots can extract huge sums from retail participants, especially in high-volatility meme tokens where price gaps form within seconds. To the human trader, it feels like bad timing, but it’s the system working perfectly - just not in their favor.

👥 Copy-trading and the exit liquidity effect

Copy-trading tools let users automatically replicate the moves of a “successful” trader. In meme markets this can backfire: if the lead trader opens a large position in an illiquid meme coin, followers pile in and push the price up, allowing the lead to sell at a profit.

Followers end up as exit liquidity - holding the token after the trend reverses. Copy-trading in such volatile, meme-driven assets turns coordinated enthusiasm into a delayed loss for most participants.

🕵️ Meme-themed phishing and impersonation

Attackers often disguise scam websites and fake social profiles as meme coin projects. They promise early access, airdrops, or presale participation, tricking users into connecting their wallets and approving malicious contracts.

Once approved, these contracts can drain tokens or stablecoins from the victim’s wallet. The most common vector is Telegram and X (Twitter), where fake “official” links spread faster than corrections. In the meme coin world, where speed and FOMO dominate, even experienced traders can be caught off guard.

🧾 Hidden taxes and silent fees

Some meme coins include hidden transaction taxes that go unnoticed until trading starts. For example, a 10–20% tax on every buy or sell, or special wallet addresses that collect part of every trade. These mechanisms can drain liquidity over time and distort prices.

While presented as anti-bot or anti-whale features, they can just as easily serve as a slow extraction mechanism benefiting the deployer.

🧠 Why meme coin schemes keep repeating

The structure of meme coins - fast creation, no regulation, and viral distribution - makes them ideal for repeating the same patterns with new faces. Each cycle brings new participants, memes, and platforms, but the incentives stay the same. The simplicity of creation and the psychology of viral humor ensure that as long as people chase quick wins, these traps will continue to appear again and again.

How traders hunt for meme coins that might moon - and avoid scams 🔍

Behind every viral meme coin that explodes in price, there are thousands that vanish without a trace. Traders who specialize in this niche combine data analysis, community observation, and instinct to filter noise and find the few tokens that could actually perform. Their process is half analytics, half social intelligence - and it’s not as random as it seems.

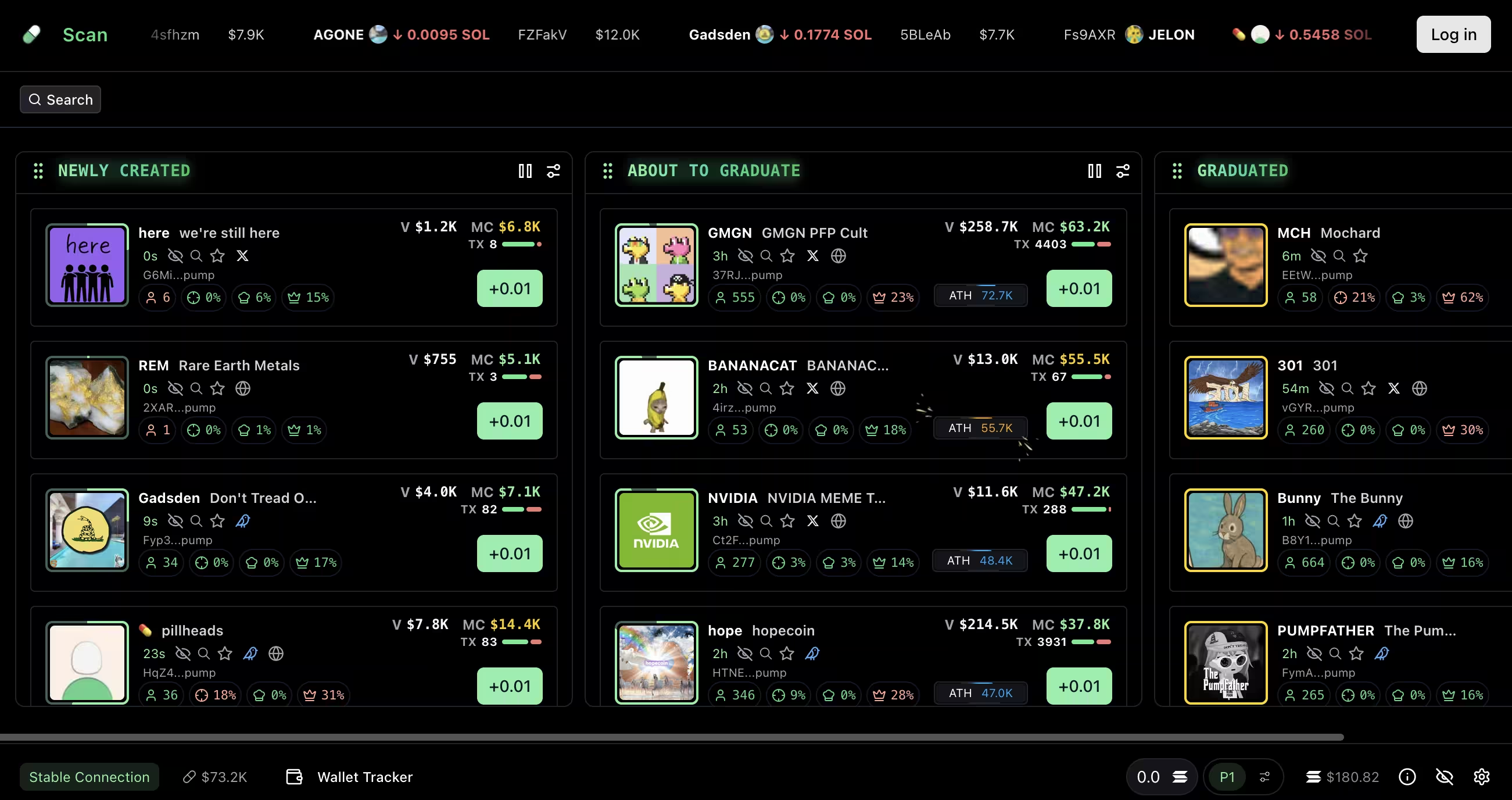

📊 Using dashboards and analytics tools

Dozens of platforms now track newly launched meme coins across blockchains. Services such as gmgn.ai, Dexscreener, or Birdeyes show on-chain statistics in real time: price charts, trading volume, number of holders, top wallet distribution, and recent buys or sells.

A typical trader filters hundreds of launches by looking at:

- 5-minute trading volume to gauge immediate interest

- market cap below a certain threshold (for example, under $5 million) to find early entries

- healthy liquidity levels relative to market cap (often at least 10–15%)

- growing number of unique buyers rather than repeated bot trades

On gmgn.ai, for example, anyone can view wallet activity, contract status, and holder distribution without paying. That transparency lets users instantly see whether a token looks organic or artificial.

🧠 Reading meme energy and social sentiment

Numbers tell only half the story - memes thrive on culture. Successful traders monitor the “meme temperature” across platforms like X (Twitter), Telegram, and Discord. They watch for repeating jokes, viral formats, or sudden phrases spreading through crypto circles.

If a meme resonates beyond a small group, the associated token often surges in parallel. Some even track sentiment bots that analyze how often a coin’s ticker appears in social media posts. In these markets, popularity itself becomes a kind of fundamental metric.

🐋 Following whales and smart money

Another part of the game is tracking experienced or high-performing wallets - often called “smart money.” Analytical platforms and Telegram bots allow users to see when these wallets buy into or exit from new meme coins.

When several known whales enter the same small-cap coin, traders interpret it as a bullish signal. However, the risk is that whales may sell first, leaving retail buyers behind. Observing wallet timing patterns is therefore as important as copying their picks.

Some traders even rely on private alpha groups, influencer calls, or early leaks from developer communities - showing how closely trading memes blends data and social networking.

🧾 On-chain safety indicators and red flags

Before entering any meme coin, seasoned participants check basic security parameters on the blockchain. The most common indicators include:

- Liquidity status: liquidity should be locked or burned; if the creator still holds all LP tokens, risk is high.

- Token distribution: a few wallets holding more than 15–20% of supply signals possible price manipulation.

- Contract permissions: functions like mint, freeze, or blacklist increase the chance of abuse.

- Ownership: if contract ownership hasn’t been renounced, the deployer can change key parameters.

- Renounced or verified contract: transparency through verification on Etherscan or Solscan builds trust.

- Social activity vs. trading volume: a mismatch (huge online buzz but minimal volume, or vice versa) can indicate bot farming or wash trading.

Traders combine these checks with manual research - reading the token’s code, watching how liquidity grows, and comparing wallet interactions. The process is repetitive but crucial to avoid obvious traps.

🧩 Balancing instinct and discipline

Finding the next meme coin that “moons” is a mix of intuition and structured screening. The most successful participants treat it like data-driven entertainment: they use dashboards to filter risks but accept that most picks will fail.

Even with the best analytics, these markets remain chaotic by design. Hype, timing, and culture dominate over fundamentals. But by verifying contracts, monitoring liquidity, and observing real community activity, traders at least shift the odds slightly in their favor - and avoid the most common scams disguised as memes.

Meme coins or modern gambling? 🎰

It’s easy to understand why meme coins have become so addictive. They combine humor, the dream of quick wealth, and the energy of online communities. Every day someone posts a screenshot showing a 100x profit, and for a moment it looks real - like anyone could be next. A few people do get lucky and turn a few dollars into life-changing sums. But for the majority, that dream ends with losses, frustration, and disbelief.

Statistically, the success rate is microscopic. On platforms like Pump.fun, less than one percent of participants earn any meaningful profit. Most coins collapse within days, and almost all lose their value within weeks. Still, stories of “the next Doge” keep circulating - the same way gamblers remember jackpots, not the thousands of small losses that made them possible.

💥 The illusion of control

Meme coins have no underlying product, no revenue, and usually no roadmap beyond the meme itself. Their price depends on attention, timing, and collective excitement. Traders talk about “meme energy,” but what really drives the market is emotion and speed - the faster something trends, the higher it climbs. When the spotlight shifts, the coin fades instantly.

This dynamic gives traders a false sense of control. When luck strikes, it feels like skill; when the price crashes, they believe they’ll do better next time. In reality, they’re playing a chaotic game where information moves faster than human reaction. A few get rich by accident; most get trapped chasing volatility.

🧠 The psychology of meme speculation

The behavior around meme coins closely mirrors gambling. Both rely on unpredictable outcomes, instant feedback, and emotional highs. The rush of watching a token double in seconds feels the same as a winning spin in a casino. The next crash triggers the same spiral of chasing losses - a psychological loop known as “tilt.”

For many traders, meme-coin activity becomes a form of entertainment. They stay glued to Telegram and price charts not because they believe in long-term growth but because of the thrill. The community becomes part of the experience, like a digital arena where emotion matters more than math.

🏦 The house always wins - but here the house has no rules

In a casino, odds are still regulated. There are laws requiring transparency, limits on payout ratios, and guarantees that games operate within defined probabilities. You might lose, but at least the system follows measurable standards.

With meme coins, even that structure doesn’t exist. There are no defined odds, no regulators setting fairness rules, no mechanisms guaranteeing that markets function transparently. Smart contracts can be changed, liquidity can vanish, and influencers can manipulate sentiment without consequence. The ecosystem runs on trust and attention - two of the most unstable currencies in existence.

The platforms hosting meme coins, however, always profit. Every transaction carries a fee. Every hype cycle generates new liquidity for the system, regardless of who wins or loses. The result is a market where entertainment is monetized and risk has no ceiling.

💸 Speculation as culture

Despite the chaos, meme coins are not just financial instruments. They’re a reflection of modern internet culture - a blend of humor, rebellion, and collective creativity. Owning a meme token often means belonging to a tribe, sharing jokes, and participating in a global digital theater where finance meets irony.

For that reason, the meme-coin phenomenon will likely never disappear. It’s not only about profit; it’s about identity and shared emotion. But this same mix makes it dangerous: when humor meets speculation, the line between fun and financial risk becomes almost invisible.

🎯 Final thoughts

Yes, you can make money with meme coins - some people genuinely do. But the odds are worse than in gambling, because even casinos have rules. There’s no regulator, no fixed payout ratio, no assurance that the game is fair. In meme trading, everything depends on timing, hype, and luck.

That’s why calling it “the new casino” isn’t just a metaphor. It’s a system built on pure probability, but without the boundaries that make gambling at least partially predictable. Here, volatility replaces regulation, and emotion replaces skill.

For anyone entering this world, the only realistic approach is awareness: enjoy the memes, stay curious, but never confuse entertainment with investment - and never risk more than you can afford to lose.