DeFi Strategies 2026: Master Guide from Passive Yield to Advanced Leverage

DeFi strategies in 2026 are no longer about choosing a single protocol or chasing the highest APY. Modern decentralized finance requires a portfolio-based approach where capital is distributed across multiple risk layers, from relatively stable yield mechanisms to advanced leverage and recursive borrowing strategies. This guide explains how different DeFi strategies fit together, how their risks and returns interact, and how investors can scale from passive income toward more complex capital-efficient structures without breaking portfolio balance.

Table of Contents:

- 🧭 DeFi Strategies at a Glance

- 🌐 DeFi in 2026: From Simple Yield to Capital Architecture

- 🧱 Conservative Layer: Yield Foundations

- ⚙️ Optimization Layer: Yield Farming and Liquidity Providing

- 🔄 Market-Neutral Strategies: Income Without Directional Bets

- 🚀 Aggressive Layer: Looping and Leverage

- 🛡️ Risk Management and Smart Contract Exposure

- 🧠 Building a DeFi Strategy Portfolio in 2026

DeFi Strategies at a Glance 🧭

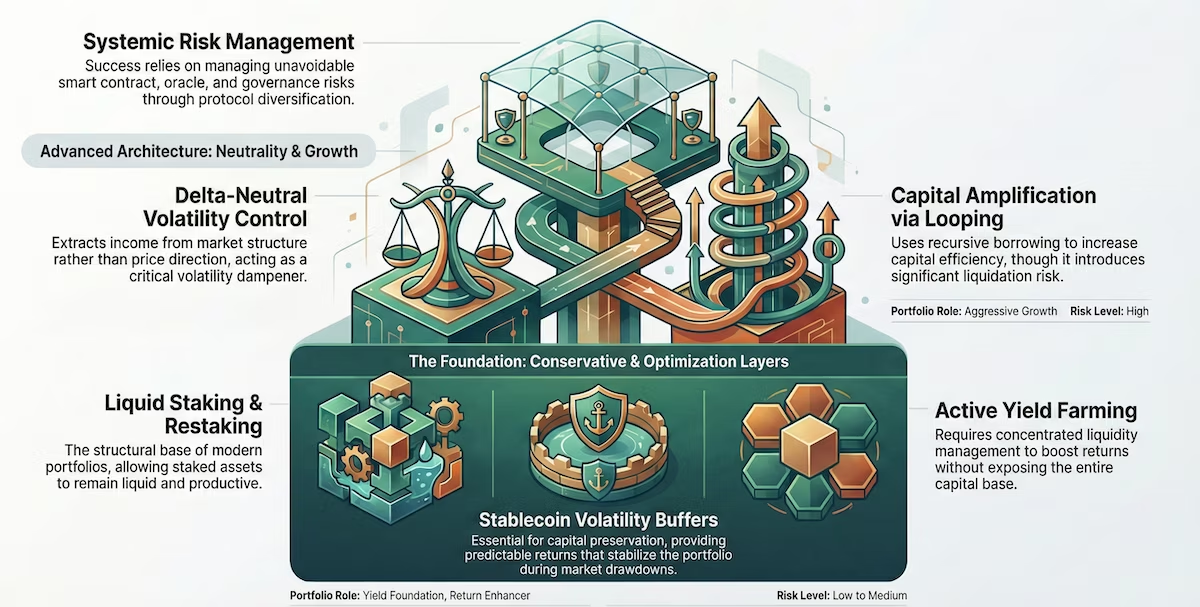

| Strategy Category | Risk Level | Core Purpose | Typical Users | Portfolio Role |

|---|---|---|---|---|

| Liquid Staking and Restaking | Low to Medium | Baseline yield on core assets | Long-term holders | Yield foundation |

| Stablecoin DeFi Income | Low | Capital preservation with yield | Conservative allocators | Volatility buffer |

| Yield Farming and LP | Medium | Yield optimization | Active managers | Return enhancer |

| Delta-Neutral Strategies | Medium | Market-neutral income | Risk-aware investors | Volatility control |

| Looping and Leverage | High | Capital efficiency and amplification | Advanced users | Aggressive growth |

DeFi in 2026: From Simple Yield to Capital Architecture 🌐

The DeFi landscape has matured into a layered financial system where strategies are defined not only by yield, but by capital efficiency, liquidity constraints, and liquidation dynamics. Passive buy-and-hold approaches increasingly underperform when compared to structured portfolios that combine multiple income sources. In 2026, the key differentiator is not access to protocols, but the ability to design a strategy stack that adapts to market conditions while controlling downside risk.

Rather than viewing DeFi products in isolation, experienced investors now think in terms of portfolio architecture. Each strategy occupies a specific role, whether generating baseline yield, stabilizing returns, or amplifying exposure when conditions allow.

Conservative Layer: Yield Foundations 🧱

Liquid staking has become the structural base of many DeFi portfolios. By staking assets such as ETH or SOL through liquid staking tokens, investors maintain liquidity while earning protocol-level rewards. This transforms traditionally idle capital into a productive asset that can be redeployed across DeFi without sacrificing staking income.

Restaking systems like EigenLayer extend this concept further by allowing staked assets to secure additional services and protocols. While restaking introduces new slashing and smart contract risks, it effectively increases capital productivity and creates a new yield layer that sits between passive income and active DeFi strategies.

Stablecoin-based DeFi income occupies a similar foundational role. Lending stablecoins through major protocols provides relatively predictable returns and acts as a volatility buffer during market drawdowns. These strategies are not designed to outperform aggressive yield plays, but to preserve capital while keeping it productive.

For readers looking for purely passive approaches, the mechanics of these strategies are covered in detail in the Passive Income with Crypto section of our site.

Optimization Layer: Yield Farming and Liquidity Providing ⚙️

Yield farming in 2026 is fundamentally different from early DeFi cycles. Concentrated liquidity models and advanced AMM designs require active management, range adjustments, and risk awareness. Liquidity providers are no longer paid simply for supplying capital, but for managing exposure efficiently.

Providing liquidity on modern decentralized exchanges can significantly enhance returns, but it introduces impermanent loss, execution risk, and dependency on market structure. As a result, liquidity providing fits best as an optimization layer rather than a core holding. Investors typically allocate a limited portion of their portfolio to these strategies to boost returns without exposing the entire capital base to market microstructure risk.

These strategies demand attention and monitoring, making them unsuitable for investors seeking a hands-off approach.

Market-Neutral Strategies: Income Without Directional Bets 🔄

Market-neutral strategies occupy a critical middle layer between passive yield and aggressive leverage. Their purpose is not to outperform the market during strong trends, but to extract relatively stable income when price direction is uncertain or volatility is elevated. In a mature DeFi portfolio, these strategies act as a volatility dampener rather than a return maximizer.

Delta-neutral yield is achieved by structuring positions so that gains and losses from price movements largely offset each other. This is commonly done by pairing spot exposure with derivatives or funding-rate mechanisms, allowing investors to earn from market structure rather than from directional price appreciation. In effect, capital is deployed to monetize imbalance between demand for leverage and available liquidity.

Unlike liquid staking or stablecoin lending, market-neutral strategies are operationally intensive. They require active monitoring, precise position sizing, and an understanding of liquidation mechanics and funding dynamics. However, when implemented correctly, they play a key role in smoothing portfolio returns during sideways or choppy market conditions where directional strategies tend to underperform.

These approaches are best understood as part of a broader strategic framework rather than standalone yield products. They sit conceptually between conservative income layers and high-risk leverage, bridging the gap between capital preservation and capital amplification. Readers unfamiliar with how these strategies fit into the wider DeFi ecosystem may benefit from reviewing the broader system-level overview in our DeFi Guide 2026 — Master Your Wealth in Decentralized Finance.

It is also important to distinguish market-neutral positioning from leveraged directional exposure. While both may use borrowing and derivatives, their objectives and risk profiles differ substantially. A detailed comparison of recursive borrowing and direct leverage, including how these mechanisms interact with liquidation risk and funding costs, is explored in our in-depth analysis of DeFi looping vs. leveraged long.

Within a portfolio context, market-neutral strategies are most effective when used selectively and sized conservatively. They are not designed to replace passive income layers, nor to compete with aggressive leverage, but to provide structural balance during periods when market direction is unclear.

Aggressive Layer: Looping and Leverage 🚀

Advanced DeFi strategies focus on capital efficiency rather than raw yield. Looping, recursive borrowing, and leveraged positions allow investors to amplify exposure using lending protocols instead of centralized derivatives.

While looping and direct leveraged longs may appear similar, their risk profiles differ significantly. Looping embeds leverage within lending markets, creating liquidation risks tied to collateral ratios and protocol mechanics rather than market price alone. Direct leverage, on the other hand, concentrates risk in price movements and funding costs.

A detailed comparison of these approaches, including their mathematical foundations and risk dynamics, is explored in our DeFi Looping vs Leveraged Long guide.

These strategies should only occupy a small portion of a diversified portfolio and are best reserved for investors who fully understand liquidation mechanics, interest rate variability, and smart contract risk.

Risk Management and Smart Contract Exposure 🛡️

Every DeFi strategy ultimately depends on smart contracts, making technical risk unavoidable. Protocol bugs, governance failures, oracle manipulation, and stablecoin depegging represent systemic threats that cannot be diversified away through yield alone.

Effective risk management in DeFi involves protocol selection, capital distribution across chains and platforms, and continuous monitoring. Portfolio tracking tools allow investors to visualize exposure, manage collateral ratios, and react quickly to changing conditions.

Risk is not eliminated in DeFi, but it can be structured and controlled through intentional portfolio design.

Building a DeFi Strategy Portfolio in 2026 🧠

A practical DeFi portfolio combines multiple strategy layers rather than relying on a single source of yield. Smaller portfolios often prioritize simplicity, using liquid staking and stablecoin income as their core. Mid-sized portfolios add yield farming or market-neutral strategies to enhance returns. Large portfolios may allocate a controlled portion of capital to looping and leverage, accepting higher risk in exchange for greater capital efficiency.

The defining skill for DeFi investors in 2026 is not discovering new protocols, but understanding how strategies interact, how risks compound, and when to rebalance. DeFi has evolved from experimental yield hunting into a modular financial system, and successful participants are those who treat it as such.