How to earn with Binance Simple Earn and Dual Investment

Binance Simple Earn and Dual Investment are two popular ways to earn passive income on your crypto. With Simple Earn, you subscribe your idle crypto to get a predictable, stable yield, much like a traditional bank deposit. Dual Investment, on the other hand, offers higher potential returns but comes with a crucial risk—your crypto may be converted into a different asset if the market price hits a specific target. This guide will break down these two powerful tools in the Binance Earn ecosystem: Simple Earn for conservative investors seeking stable returns, and Dual Investment for those ready for calculated risks in exchange for high yields. We’ll explore how they work, the potential risks, and actionable strategies to help you make informed investment decisions.

Binance Simple Earn — Your Crypto Savings Account

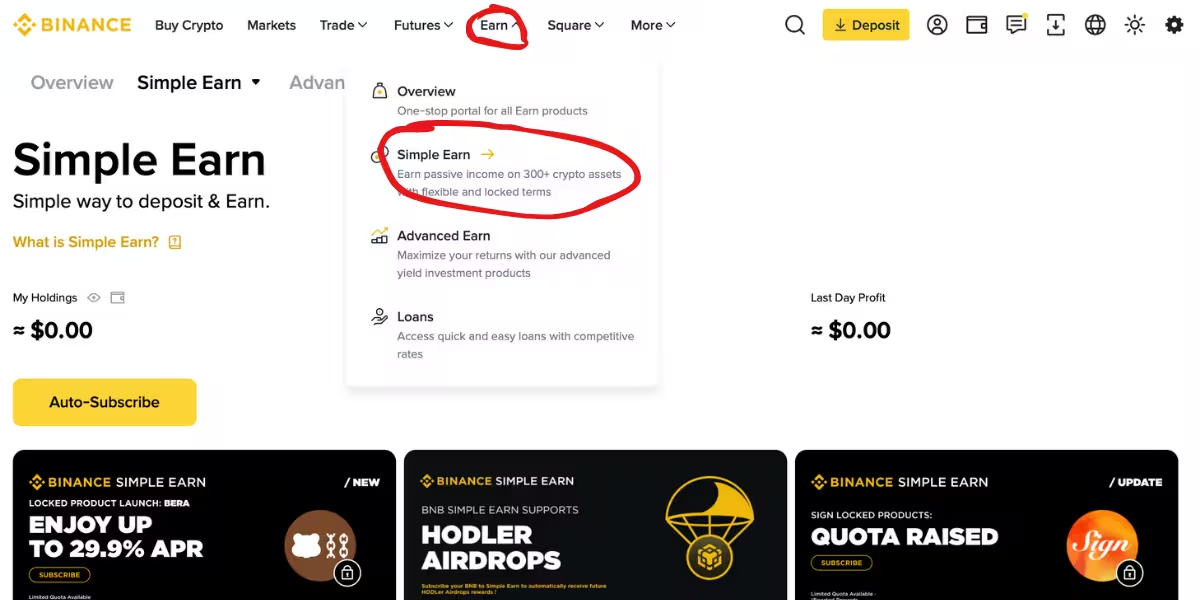

What is Simple Earn and How Does It Work?

Binance Simple Earn is the foundational product of the Binance Earn ecosystem, functioning much like a traditional bank’s savings account. It’s a principal-protected product, meaning you are guaranteed to get back the same amount of tokens you deposited, plus the interest you’ve accrued.

The principle is straightforward: you deposit your crypto assets and receive daily rewards. Instead of gathering dust in your spot wallet, your assets are put to work, generating a steady stream of income.

How Does Binance Afford to Pay You?

Many users wonder where the yield comes from. Binance generates revenue by using the pooled funds from Simple Earn in several ways:

- Margin & Institutional Lending: Binance lends the assets to traders for margin trading and to large institutional clients or market makers who need liquidity. They pay interest on these loans.

- Staking Operations: A portion of the funds is used for staking on Proof-of-Stake (PoS) blockchains, earning staking rewards for helping to secure the network.

- Liquidity Provision: Assets are used to provide liquidity for various services on the platform, such as the futures market, which generates fees.

Binance takes a small margin from the profits generated and distributes the rest to Simple Earn users as an Annual Percentage Rate (APR).

Flexible vs. Locked: Choosing Your Strategy

Binance Simple Earn has two options: Flexible and Locked products. Understanding the difference between them is key to choosing the right strategy for your investment goals and risk tolerance. Flexible products offer liquidity and convenience, while Locked products provide a higher, more stable yield in exchange for committing your crypto for a fixed period.

1. Flexible Products

Mechanism. Flexible products behave like a liquid savings pocket: you can redeem your funds at any time without penalties, and rewards accrue continuously (calculated every minute and reflected in your balance). That makes them a convenient “parking spot” for idle capital between trades or when you want to stay nimble.

Yield. Because you keep full control over liquidity, the APR is variable and typically lower than in Locked products. Rates drift with borrowing demand, on-chain yields, and platform liquidity needs, and they also depend on the asset you choose. For example, at the time of writing you might see SOL Flexible ≈ 2.92% APR, while USDT Flexible ≈ 11.97% APR. Note that some assets (like USDT in this example) do not offer a Locked term at all—Flexible is broadly available, but Locked availability varies by currency and term, and promos can change these figures.

Who it’s for. Flexible is a natural fit for beginners who are testing the waters, active traders who may need to deploy funds on short notice, and conservative investors who value access over maximum return. It also pairs well with auto-subscribe/auto-reinvest so rewards don’t sit idle.

2. Locked Products

Mechanism. Locked products are closer to a term deposit. You choose a fixed tenor—7, 30, 60, 90, or 120 days—and lock your assets until maturity. The rate is fixed at subscription, so you know in advance how much you’ll earn if you hold to the end of the term.

Yield. Committing your liquidity earns a meaningfully higher APR than Flexible, when a Locked term is offered for that asset. The exact uplift depends on the token and term. For instance, you might see SOL Locked (120d) ≈ 5.1% APR versus SOL Flexible at ~2.92%. By contrast, USDT in our example has no Locked option, so its Flexible rate (e.g., ~11.97% APR) is the only one available. Always check the asset’s card—Locked is not universally available, and short promotional windows can push certain terms higher.

Risk & trade-offs. The main trade-off is illiquidity until the maturity date. If you redeem early, accrued rewards are typically forfeited—that’s how the product incentivizes your time commitment. To manage liquidity needs, consider splitting a large amount into a ladder of several smaller locks with staggered end dates.

Who it’s for. Locked fits investors with a clear mid-term plan who are confident they won’t need the funds for weeks or months and who want to maximize predictable returns without constant micromanagement.

3. Auto-Subscribe & The Power of Compounding

Auto-Subscribe quietly keeps your money working: whenever you have idle assets in your Spot Wallet, they’re automatically swept into Simple Earn (Flexible) and any rewards you accrue are reinvested back into the same product. In practice, that turns a plain APR into an APY-like experience—your rewards start earning their own rewards without you doing anything. If a Locked term is available and you enable it (or if the asset supports re-enrollment at maturity), the proceeds can roll into Flexible again so nothing sits idle between terms. The compounding effect is what makes this powerful. With simple interest, you earn a flat percentage on your original principal. With compounding, each new reward is added to the base, so the next reward is calculated on a slightly larger amount. Over time—especially with larger balances or longer horizons—that difference compounds into real money.

Example. Start with $10,000 USDT at 8% APR for one year.

- Simple interest yields $800, ending at $10,800.

- With daily compounding, the effective return is about 8.33% APY, so your balance ends near $10,832.87—roughly $32.87 more for doing nothing extra. Stretch that to 3 years and the gap widens: simple interest would land around $12,400, while daily compounding gets you roughly $12,716—about $316 extra.

Two practical notes. First, APRs change with market demand and asset type, so the exact APY will float; Auto-Subscribe simply ensures whatever you do earn is continually put back to work. Second, if you trade frequently, consider leaving a small buffer on Spot so Auto-Subscribe doesn’t sweep every last unit you might need for fees or quick orders.

Binance Dual Investment — High-Yield Strategic Plays

The Concept: How Dual Investment Works

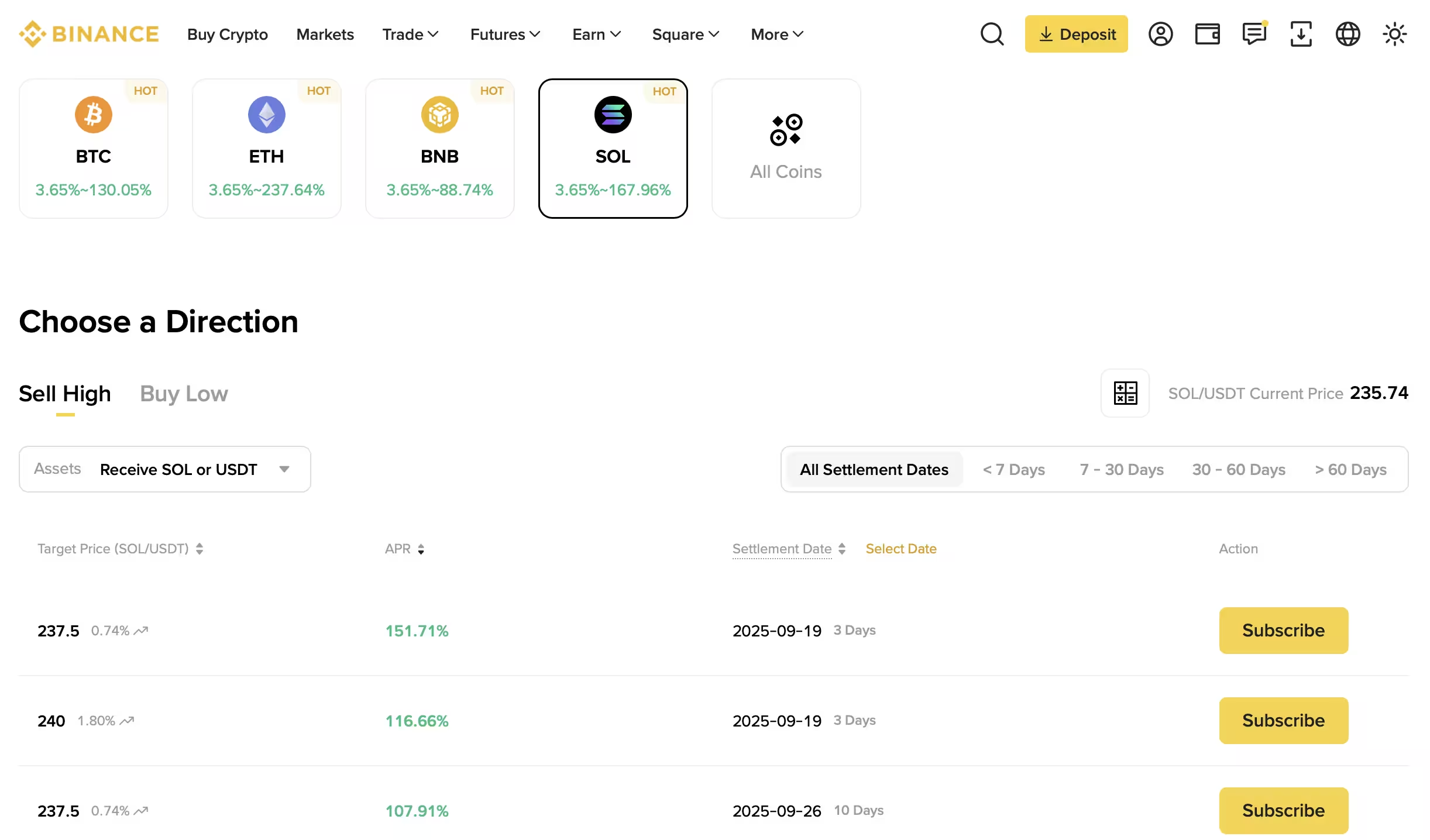

Binance Dual Investment is a high-yield, non-principal-protected product. In practice, you’re selling an option for a set Target Price and Settlement Date in exchange for a fixed premium (APR). Your premium is earned either way; what changes on the settlement date is whether you convert into the alternate asset.

You bet on whether an asset’s price will reach a specific Target Price by a future Settlement Date. Your main, guaranteed profit is the high-yield premium (APR), which you receive regardless of the outcome.

The Two Scenarios: “Sell High” and “Buy Low”

1. “Sell High” Scenario

Choose “Sell High” when you already own the coin and would be comfortable selling it if it rallies to a predefined level. You commit now to sell at a Target Price on a future Settlement Date, and in return you lock in a fixed premium (APR) while you wait. If, on settlement, the market is at or above your target, the sale executes and you receive USDT + the premium; if it’s below, no sale happens—you keep your coin and still collect the premium (paid in the deposit asset). In short, this is a way to monetize your take-profit level with known yield, in exchange for capping upside above the Target Price.

Example:

- Current BNB Price: $580.

- You hold: 1 BNB.

- You set a Target Price of $620 for a 14-day term with a 30% APR.

Possible Outcomes on the Settlement Date:

- BNB Price ≥ $620: Your 1 BNB is automatically sold for $620. You receive $620 USDT + your interest (also paid in USDT). You successfully sold high and earned an extra premium.

- BNB Price < $620: The sale does not happen. You get back your 1 BNB + your interest (paid in BNB). You didn’t sell, but you increased your BNB holdings.

The Main Risk: Opportunity Cost. If the BNB price skyrockets to $700, you still only sell at $620.

2. “Buy Low” Scenario

Use this when you’re holding stablecoins and are willing to commit to buying the asset if it dips to your Target Price by the Settlement Date—earning a fixed premium while you wait.

Example:

- Current BNB Price: $580.

- You hold: USDT.

- You set a Target Price of $550 for a 14-day term with a 25% APR. You subscribe with the amount you wish to spend (e.g., $550 USDT).

Possible Outcomes on the Settlement Date:

- BNB Price ≤ $550: Your $550 USDT is used to buy 1 BNB at your target price. You receive 1 BNB + your interest (paid in BNB). You successfully bought the dip.

- BNB Price > $550: The purchase does not happen. You get back your $550 USDT + your interest (paid in USDT). You didn’t buy the asset, but you earned a high yield on your stablecoins.

The Main Risk: If the BNB price crashes to $500, you still buy at your target of $550, meaning you overpaid relative to the current market price.

Dual Investment vs. Long/Short Trading

Dual Investment and long/short trading both express a market view, but they work very differently: Dual is effectively option-selling wrapped in a simple UI—you pre-commit to buy lower or sell higher by a Settlement Date and earn a fixed premium (APR) regardless of the path, with key trade-offs of opportunity cost and possible asset conversion at settlement; long/short trading is directional exposure where PnL comes from price change between entry and exit, often uses leverage, is path-dependent (you manage stops, funding, margin), and carries liquidation risk with no guaranteed income.

| Parameter | Dual Investment | Long/Short Trading |

|---|---|---|

| Profit Source | Fixed Premium (APR) | Price difference between entry/exit |

| Main Risk | Opportunity Cost, Asset Conversion | Liquidation, Total loss of capital |

| Guaranteed Income | Yes (the premium) | None |

| Liquidation Risk | None | High (with leverage) |

| Purpose | Passive Income, Strategic Portfolio Management | Speculation |

Risks and Practical Strategies

Key Risks of Dual Investment You Must Understand

- Opportunity Cost: This is the biggest risk. You miss out on potential gains if the market moves significantly beyond your target price. For example, you set a “Sell High” for BTC at $70,000, but the price shoots to $85,000. You’ve missed out on $15,000 of profit per BTC.

- Asset Conversion Risk: You might not get back the asset you started with. Subscribing with BTC might result in you receiving USDT, which is disadvantageous in a strong bull market.

- Liquidity Risk: Your funds are locked until the settlement date. There is no option for early withdrawal.

Practical Strategies for Using Binance Earn

For Simple Earn:

- “Deposit Laddering” Strategy: Split your capital and subscribe to Locked products with different expiry dates (e.g., 30, 60, 90 days). This ensures a portion of your funds becomes liquid regularly, allowing you to react to market changes or reinvest at new rates.

- The “80/20” Strategy: Keep 80% of your capital in high-yield Locked products and 20% in Flexible products to maintain liquidity for trading opportunities.

For Dual Investment:

- “Accumulating on Dips” Strategy: Regularly use the “Buy Low” feature to systematically accumulate your favorite assets at attractive prices, all while earning a premium even if the orders don’t execute.

- “Strategic Profit-Taking” Strategy: When your portfolio grows, use the “Sell High” feature to lock in profits at pre-determined price targets, earning extra yield while you wait.

Simple Earn vs. Dual Investment: Side-by-Side Comparison

| Criterion | Simple Earn — Flexible | Simple Earn — Locked | Dual Investment — Sell High | Dual Investment — Buy Low |

|---|---|---|---|---|

| What it is | Liquid “crypto savings” with real-time rewards | Term deposit with fixed tenor and rate | Commit to sell higher at a Target Price; earn a fixed premium | Commit to buy lower at a Target Price; earn a fixed premium |

| Profit source | Share of lending / staking / liquidity revenues | Same as Flexible, plus a term premium for predictability | Option premium (APR) for agreeing to sell at target | Option premium (APR) for agreeing to buy at target |

| Yield profile (examples) | Variable by asset (e.g., SOL Flexible ≈ 2.92%, USDT Flexible ≈ 11.97%); changes with demand | Typically higher than Flexible (e.g., SOL Locked 120d ≈ 5.1%); not all assets have Locked | Often higher than deposits; premium fixed at subscription; upside capped above target | Often higher than deposits; premium fixed at subscription; entry capped at target |

| Fees / commissions | Low/implicit. No trade fee; Binance keeps a spread from earned revenues | Low/implicit. No trade fee; early redemption forfeits rewards | No trading fee / funding. Premium is your income; conversion uses Target Price | No trading fee / funding. Premium is your income; conversion uses Target Price |

| Liquidity | Anytime redemption | Locked until maturity (early exit usually loses rewards) | Locked until settlement | Locked until settlement |

| Capital protection (in tokens) | Yes (token amount) — fiat value can fluctuate | Yes (token amount) — fiat value can fluctuate | No — may convert coin → USDT at target | No — may convert USDT → coin at target |

| Main risks | Market price risk in fiat terms | Illiquidity + market price risk; early exit = loss of rewards | Opportunity cost; asset conversion to USDT at settlement | Opportunity cost; asset conversion to the coin at settlement |

| Complexity | Very low | Low | Moderate (target / settlement mechanics) | Moderate (target / settlement mechanics) |

| Best for | Beginners, traders needing quick access, liquidity-first holders | Planners with a cash cushion and a clear time horizon | Holders willing to take profit at a target and get paid to wait | Stablecoin holders wanting to buy the dip and get paid to wait |

| Good scenarios | Parking idle funds; auto-subscribe for APY-like effect | Laddering 30/60/90/120d to smooth liquidity and boost yield | You own BNB/BTC and would sell at that level anyway | You hold USDT/USDC and want entry at that level anyway |

| Not ideal if | You require maximum yield above all else | You might need funds before maturity | You can’t accept selling if price rips higher | You can’t accept buying if price dumps lower |

Notes: Yields vary by asset and time; Locked availability differs across tokens (e.g., some stablecoins may have Flexible only). Numbers shown are examples — replace with current rates from the product pages.

Conclusion

Binance Simple Earn and Dual Investment are powerful tools for generating passive income. Simple Earn is the perfect starting point, offering safe, predictable returns for conservative investors. Dual Investment is a more advanced tool that provides exceptional yields for those with a clear market outlook and an understanding of the associated risks.

Success with these products requires a clear understanding of your financial goals, time horizon, and risk tolerance. Start small, learn the mechanics, and always do your own research.

Watch and Learn: Additional Video Guides

While this guide covers all the essentials, sometimes it’s best to see things in action. We’ve handpicked a couple of video tutorials from other creators that walk you through the process of using both Binance Simple Earn and Dual Investment. These videos offer a visual breakdown of the steps, from subscribing to tracking your earnings, so you can get started with confidence.

FAQ

What is Simple Earn in plain English?

Think of Binance Simple Earn as a crypto savings account. You deposit idle coins (e.g., USDT, BTC, ETH), and Binance accrues rewards on them daily. It’s the easiest, lower-risk way to put your assets to work instead of letting them sit in your spot wallet. A key point is principal protection in tokens: you’ll get back the same number of tokens you deposited, plus all accrued rewards.

What’s the main difference between Flexible and Locked?

It’s a trade-off between yield and access to your funds. Flexible: You can redeem anytime without penalties or losing accrued rewards, so liquidity is maximized. The trade-off is a lower APR. Great if you might need quick access. Locked: You “lock” funds for a set term (e.g., 30/60/120 days) and receive a higher, fixed APR. The catch: early redemption typically forfeits all accrued rewards. Best if you won’t need those funds soon and want a higher, more predictable return.

Can I lose my money in Simple Earn?

You won’t lose the amount of tokens you deposited. The product is principal-protected in tokens (e.g., deposit 1 ETH → you’ll get back 1 ETH + rewards). However, the fiat value of your crypto can change. If ETH’s price falls, the dollar value of your position may drop even as your token balance grows. Binance protects the token amount, not the fiat value.

Where does Binance get the money to pay interest?

Binance pools user funds from Simple Earn and uses them to generate revenue, for example by lending to margin/futures traders and institutional clients, providing liquidity, and staking on supported networks. A portion of that revenue is shared back with you as rewards (APR/APY).

What is Binance Dual Investment, in simple terms?

You make a commitment for a future date: either sell your crypto above today’s price (Sell High) or buy crypto below today’s price (Buy Low). In return, you lock in a guaranteed premium (APR) for taking on that obligation. The premium is paid at settlement; whether you end up converting assets depends on where the market price is relative to your Target Price on the Settlement Date.

What’s the biggest risk in Dual Investment? Can I lose everything like with futures?

The main risk is opportunity cost, not liquidation. Sell High example: You agreed to sell BNB at $620, but it moons to $700. You’ll still sell at $620, earning your premium but missing the extra $80 upside. Buy Low example: You agreed to buy BNB at $550, but it drops to $500. You’ll still buy at $550, paying more than the market at that moment. You don’t face forced liquidation like leveraged futures, but you can underperform a different market path.

How is “Sell High” different from a regular limit sell order?

They look similar but behave differently. Limit sell: If price never reaches your level, nothing happens and you earn nothing. Dual Investment — Sell High: If price doesn’t reach your level, you also don’t sell—but you still earn the premium for waiting. The same logic applies to Buy Low versus a limit buy.

What should a beginner choose: Simple Earn or Dual Investment?

Start with Simple Earn. It’s straightforward, predictable, and avoids conversion or opportunity-cost risks. Try Flexible first to get comfortable, then consider Locked for higher rates if you can part with liquidity.Dual Investment is better for experienced users who understand price dynamics, have clear target levels, and are comfortable with conversion and opportunity-cost trade-offs in exchange for higher potential yield.